405 Howard Street San Francisco charge on Credit card full Info

today we discover the details behind the charge from 405 Howard Street on your credit card to ensure the security of your financial transactions. Learn how to identify it on your statement and ensure it’s valid. Hey friends, today we learn how to handle a 405 Howard Street San Francisco charge on your credit card. Discover steps to identify, report, and resolve unauthorized charges to protect your finances. Have you spotted a confusing charge on your credit card statement from 405 Howard Street, San Francisco? Don’t panic! This guide will help you identify the source of the charge and take the necessary steps to resolve it.

Understanding the 405 Howard Street San Francisco Charge

Before initiating the dispute process, it’s essential to have a clear understanding of the charge associated with 405 Howard Street, San Francisco, and check with family if they made the purchase. This could range from erroneous transactions to unauthorized charges. Review your credit card statement meticulously to identify the specific credit card transaction in question.

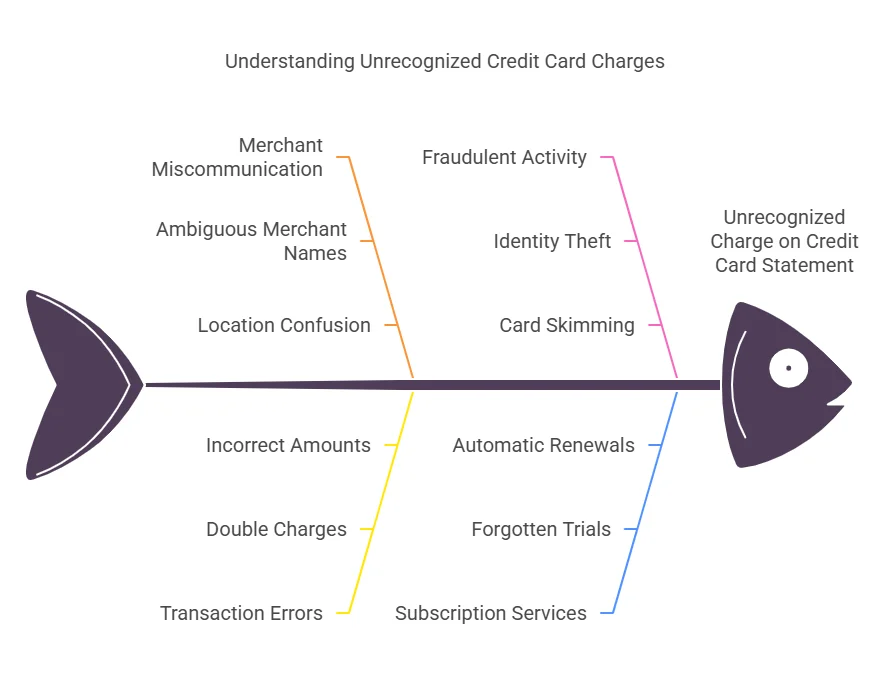

Possible Reasons for the Charge

Since 405 Howard Street is a commercial address, the charge on your account may require further investigation to ensure the security of your finances. card These charges could originate from various businesses, including those like 405 Howard Street on your credit card statement. Here are some common possibilities:

- Recurring Subscription: Did you recently sign up for a service with a company located at 405 Howard Street? This could be anything from a gym membership to one of the businesses at 405 Howard Street in San Francisco. Check your emails or account history for recurring charges.

- One-Time Purchase: Did you visit a store or restaurant at 405 Howard Street? The business name on your statement might differ slightly from the actual store name.

- Hidden Fees on your credit card statement may be a concern. Be wary of services that advertise a headline price but tack on additional fees during checkout, as this can lead to unexpected charges from this address. Review your purchase confirmation or receipt for the name of their parent company. details regarding any unauthorized charges should be documented for your credit card account.

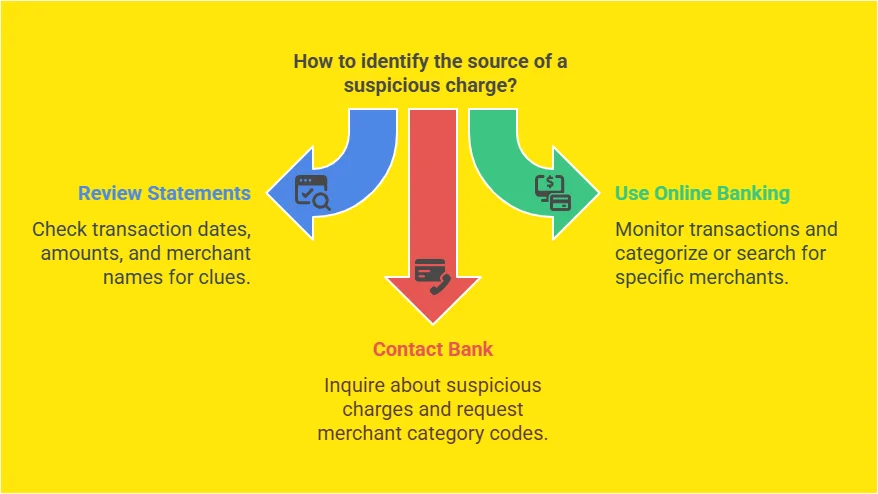

Identifying the Source of the Charge

Here’s how you can determine the source of the charge:

- Credit Card Statement: Scrutinize your credit card statements regularly for details like the transaction date, amount, and a possible merchant name abbreviation that could indicate a charge for 405 Howard.

- Online Banking can help you monitor your transactions and catch any discrepancies related to your credit card number. Many banks allow you to categorize transactions or search for specific merchants through online banking, which can help protect against unauthorized charges.

- Contact your bank regarding any suspicious charges: Your bank can provide more information about the transaction, including the merchant category code (MCC) which can offer clues about the business type.

Also read: NEW FINTECH Business Credit Card : Flexbase

Reviewing Documentation

Gather all relevant documentation pertaining to the charge, including receipts, emails, and any communication with the merchant, to help guide you through the steps of disputing the charge. Detailed documentation strengthens your case during the dispute process and provides evidence to support your claim.

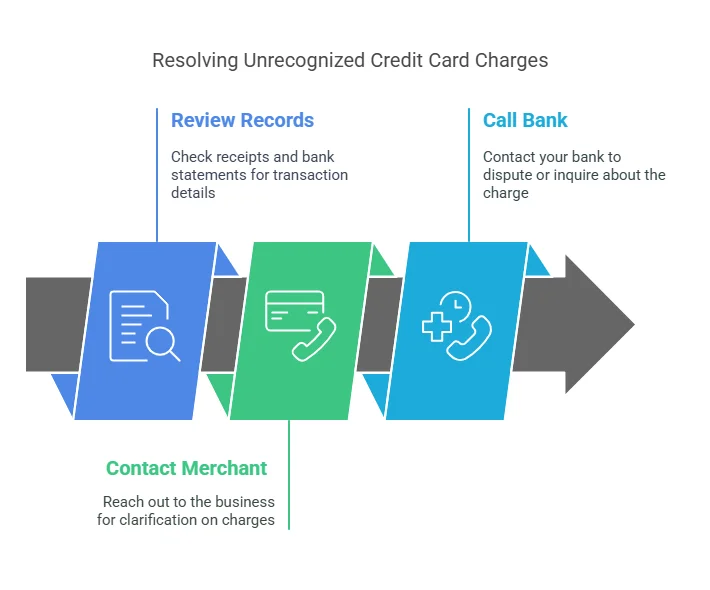

Contacting the Merchant

Initiate contact with the merchant associated with the charge to resolve any issues related to your credit card account. Communicate your concerns clearly and concisely, providing relevant details such as transaction dates, amounts, and any supporting evidence to the major credit bureaus if needed. In many cases, merchants in the heart of San Francisco are willing to resolve disputes amicably without the need for formal intervention.

Contacting the Credit Card Issuer

If direct communication with the merchant fails to yield results, contact your credit card issuer promptly to initiate the dispute process and safeguard your financial rights to charge. Provide them with all relevant details regarding the disputed charge, including documentation and any attempts made to resolve the issue with the merchant.

Submitting a Dispute Claim

Follow the procedures outlined by your credit card issuer to submit a formal dispute claim if you suspect someone used your card from 405 Howard Street without authorization. Provide detailed information regarding the disputed charge, including the reason for the dispute and any supporting documentation to ensure the security of your account. Be thorough and accurate in your Submission of a dispute claim can help resolve unauthorized charges and protect you from potential fraud. To expedite the resolution process, keep in touch with your bank regarding the status of your inquiry.

Monitoring the Dispute Status

After submitting a dispute claim, regularly monitor the status of your case through your credit card issuer’s online portal or customer service channels related to the nature of the charge. Stay proactive and responsive to any requests for additional information or documentation from the issuer.

Also read: Top Fintech Credit Cards of 2025 : Unlock the Ultimate Rewards

1. A Business You Forgot About

405 Howard Street is a bustling address in San Francisco’s SoMa district, home to a variety of businesses, from trendy cafes to tech startups, which may be relevant for checking your transaction history. It’s possible you visited a shop, restaurant, or service provider using the name associated with this address and simply forgot about the transaction. Maybe it was that quick coffee stop or a subscription service you signed up for online.

Tip: Report any suspicious transactions to the Federal Trade Commission to help safeguard your financial interests. Take a moment to think about your recent purchases and whether any of them might have resulted in a charge you don’t recognize on your credit card from 405 Howard. Sometimes, the name on the charge might not match the business name you’re familiar with.

2. A Subscription or Membership Renewal

Many companies, especially those in the tech and wellness industries, operate out of 405 Howard Street. If you’ve signed up for a subscription or membership in the past, this charge could be an automatic renewal. It’s easy to lose track of these recurring payments, especially if they’re annual or billed infrequently.

Tip: Check your email for any renewal notices or receipts. A quick search for “405 Howard Street” in your inbox might jog your memory.

3. A Third-Party Payment Processor

Sometimes, the charge might not be directly from a business at 405 Howard Street but rather through a third-party payment processor, so it’s important to review your recent transactions. Many companies use these services to handle transactions, and the processor’s address (in this case, 405 Howard Street) might appear on your statement instead of the business name.

Tip: Look for additional details on your statement, like a reference number or contact information, to help identify the charge.

4. Fraud or Unauthorized Charges

While most unrecognized charges have a simple explanation, it’s always important to rule out being a victim of credit card fraud. If you’re certain you didn’t make a purchase or authorize a payment linked to 405 Howard Street, it’s possible your card information was compromised.

Tip: Contact your credit card provider immediately to report the charge. They can investigate and, if necessary, lock your card to protect your account from further unauthorized charges.

5. A Friend or Family Member’s Purchase

If you share your credit card with a spouse, partner, or family member, they might have made a purchase without mentioning it. It’s also possible that a friend used your card for a quick payment and forgot to tell you, which could lead to a charge you don’t recognize on your credit card.

Tip: Have a quick chat with anyone who has access to your card to confirm whether they made the purchase.

What Should You Do Next?

If you’re still unsure about the charge, here’s a simple action plan:

- Review Your Records to ensure all transactions align with your expectations and verify if any francisco on your credit card is legitimate. Check receipts, emails, or bank apps for clues about any transactions related to 405 Howard Street in San Francisco, especially if you faced a charge there, as it may involve protecting your financial information.

- Contact the Merchant: Look up the business associated with 405 Howard Street in San Francisco and reach out to their customer service team to clarify any unknown charges.

- Call Your Bank: If the charge remains a mystery, your credit card issuer can help dispute it or provide more details, which could be due to various reasons including unauthorized transactions.

Resolving the Dispute

Upon resolution of the dispute, carefully review the outcome provided by your credit card issuer to ensure it reflects accurately on your credit report. If the dispute is resolved in your favor, ensure that the erroneous charge associated with 405 Howard Street, San Francisco, is promptly removed from your credit card statement.

Additional Tips

- Review Statements Regularly: Regularly monitor your credit card statements to identify any unfamiliar charges promptly.

- Enable Transaction Alerts: Consider setting up transaction alerts from your bank to receive notifications for any charges made on your card.

- Strong passwords are essential for protecting your online banking and payment processing accounts. Use strong and unique passwords for all your online accounts to minimize the risk of unauthorized access.

Final Thoughts

Unrecognized charges can be a headache, but they’re often easy to resolve; however, it’s crucial to stay informed about your financial well-being. Whether it’s a forgotten purchase, a subscription renewal, or just a case of mistaken identity, retracing your steps can bring peace of mind and help clarify any charges on your credit card as per the Fair Credit Billing Act. And if it turns out to be something more serious, your credit card company has your back and can provide the latest blog updates on how to handle such situations.

So, the next time you see 405 Howard Street, San Francisco On your statement, don’t panic—take a deep breath and start sleuthing to identify any unknown charges. You’ve got this! Remember to stay vigilant about your credit card transactions.

Related FAQ’s

Q: How can I prevent unauthorized charges on my credit card?

A: You can prevent unauthorized charges by regularly monitoring your credit card statements, using secure payment methods, keeping your personal information safe, and promptly reporting any suspicious activity to your bank or credit card issuer.

Q: What should I do if I notice a charge from 405 Howard Street San Francisco that I didn’t authorize?

A: If you notice an unauthorized charge from 405 Howard Street San Francisco, immediately contact your bank or credit card issuer to report the transaction. Provide them with details about the charge and request an investigation into the matter.

Q: Can I dispute charges from 405 Howard Street with my bank?

A: Yes, you can dispute unauthorized charges from 405 Howard Street with your bank or credit card issuer. File a dispute by providing evidence that the charge was unauthorized, such as transaction records and communication with the merchant.

Q: Are there any security measures I can take to protect my credit card information?

A: Yes, you can take several security measures to protect your credit card information, including using secure websites for online transactions, avoiding sharing your card details on unsecured platforms, and regularly updating your passwords and PINs.

Q: How long does it take to resolve unauthorized charges on a credit card?

A: The time it takes to resolve unauthorized charges on a credit card can vary depending on the complexity of the case and the policies of your bank or credit card issuer. In some instances, resolution can happen within a few days, while more complex cases may take several weeks.

Q: Is it necessary to involve law enforcement in cases of fraudulent charges?

A: In cases of significant fraud or identity theft, involving law enforcement may be necessary. Filing a police report can help document the incident and provide additional support in resolving the unauthorized charges. However, it’s advisable to consult with your bank or credit card issuer first to understand the necessary steps.

I saw a strange charge on my credit card statement from 405 Howard Street, San Francisco. Should I worry?

Not necessarily! 405 Howard Street is a commercial building housing many businesses. The charge could be from a recent purchase, a subscription, or even a hidden fee.

How can I figure out where the charge came from

Here are some tips:

Check your credit card statement: Look for details like the transaction date, amount, and any abbreviated merchant name.

Search online banking: Many banks allow you to search for specific merchants or categorize transactions.

Contact your bank: They can provide more information about the transaction, including the merchant category code (MCC) which might reveal the business type.

What should I do if I recognize the charge?

If it’s a legitimate purchase you made, you don’t need to take any action.

What if I don’t recognize the charge?

Here’s what to do:

Contact the business: Reach out to the business at 405 Howard Street and explain the situation. They might be able to clarify the charge.

Report fraud: If you suspect fraudulent activity, contact your bank immediately to report the unauthorized charge.

How can I prevent unfamiliar charges in the future?

Here are some practices to adopt:

Review statements regularly: Regularly monitor your credit card statements for any unrecognized charges.

Enable transaction alerts: Consider setting up alerts from your bank to be notified of any charges made on your card.

Use strong passwords: Create strong and unique passwords for all your online accounts to minimize unauthorized access.

Who should I contact if I need more help?

If you’re unable to resolve the issue yourself, don’t hesitate to contact your bank or credit card company for further assistance.

What’s this charge on my credit card?

It’s not uncommon to spot a charge on your credit card that you don’t immediately recognize. This could be from a recent purchase you forgot about, a subscription renewal, or even a credit card charge from a third-party payment processor. If the charge is from 405 Howard Street, San Francisco, it’s likely linked to a business located at that address. Start by checking your receipts or emails to see if it rings a bell.

Why am I getting random charges on my credit card?

Random charges can happen for a few reasons, including if your card is lost or stolen.

Recurring subscriptions: You might have signed up for a service that bills you automatically.

Forgotten purchases: That quick coffee or online order from 405 Howard Street in San Francisco might have slipped your mind.

Third-party processors may include services that could lead to a francisco charge on credit card. Sometimes, the charge shows up under the processor’s address instead of the business name.

Fraud: In rare cases, it could be an unauthorized charge.

If you’re seeing charges from a third-party processor, it’s important to contact your credit card company immediately. 405 Howard Street, San Francisco, it’s worth investigating to rule out any surprises.

How do I find out where my card charges came from?

Here’s how to play detective:

Check your statement: Look for additional details like a reference number or contact info on the back of your card to help identify the charge.

Search your emails for any notifications related to charges that may have been made with your virtual credit card. Look for receipts or confirmation messages from the business related to your credit card charge.

Google the address: A quick search for 405 Howard Street, San Francisco might reveal the business behind the charge.

Call your bank regarding any unauthorized transaction. Your credit card issuer can often provide more details about the transaction, including whether it was a legitimate charge or potential fraud.

What to do if you don’t recognize a transaction?

Don’t worry—there’s a clear plan of action:

Double-check your records when checking credit card statements for any discrepancies. Look through receipts, emails, or bank apps for clues.

Contact the merchant: Reach out to the business associated with the charge to ask for details.

Call your bank: If the charge still doesn’t make sense, your credit card issuer can help dispute it or investigate further for potential credit card fraud.

Will I be held liable for unauthorized charges at 405 Howard Street, San Francisco?

No, you won’t! Federal law protects you from liability for unauthorized charges on your credit card. If you spot a charges, San Francisco (or anywhere else) that you didn’t authorize, report it to your credit card issuer immediately. They’ll investigate and remove the charge if it’s fraudulent.

Disclaimer:

The information provided in this article is for general informational purposes only and is not intended as financial, legal, or professional advice. While we strive to ensure the accuracy and completeness of the content, we make no guarantees regarding the validity, reliability, or applicability of the information to your specific situation. Charges appearing on your credit card statement from 405 Howard Street, San Francisco, may vary in origin, and it is your responsibility to verify the source and legitimacy of any transaction with your credit card issuer or the merchant involved. Always consult with your bank, credit card company, or a qualified professional for personalized guidance on handling unrecognized charges, disputes, or potential fraud. The author and publisher are not liable for any actions taken based on this article or for any financial loss or damages that may result.

0 Comments on “405 Howard Street San Francisco charge on Credit card full Info”