Understanding the “Bridgepointe PUS San Mateo, CA” Charge on Credit Card Statement

If you’ve spotted a charge labeled “Bridgepointe PUS San Mateo using your credit card CA” on your credit card statement, you’re not alone. Report the unauthorized charge if you notice discrepancies or unauthorized charges. By reviewing your transaction details should be reviewed to check the charge.s, you can ensure the legitimacy of the charge. Many people wonder what this Charge on your credit card can affect your balance and should be monitored closely. means and whether it’s legitimate. This guide will help you understand the possible reasons behind this transaction, how to verify it, and what to do if it’s an unauthorized charge.

What Is the “Bridgepointe PUS San Mateo, CA” Charge?

The charge is typically linked to the their Shopping Center, a popular retail hub in San Mateo, California, which is related to bridgepointe The “PUS” in the descriptor likely stands for “Point of Sale” or “Payment Utility Service,” indicating a purchase Or payment made at one of the clothing businesses in the area could be the source of the charge. The shopping center offers a wide range of stores, restaurants, and services, making it a common source of credit card charges may have noticed discrepancies or unauthorized charges..

The History of Bridgepointe Pus San Mateo ca Charge on credit card

The “Bridgepointe San Mateo” charge typically originates from purchases made at Bridgepointe Shopping Center in San Mateo, California, which may include consumer electronics or dining options. This retail hub houses various stores, restaurants, and service providers. If this charge appears on your statement, it likely corresponds to a transaction at one of these businesses. Always verify your bills and transaction history to confirm legitimacy.

Common Reasons for the Charge

Here are some possible explanations for the charge on your credit card:

- Retail PurchasesIf you’ve shopped at stores like Target, Best Buy, or other retailers in the electronics sector, be sure to check your receipts for any unexpected charges. their Shopping Center, this charge could reflect your recent dining options. transaction.

- Dining or Entertainment: The center is home to several restaurants and entertainment venues. If you dined out or attended an event there, the charge might be related to your recent dining options and could be part of your monthly expenses.

- Subscription or Membership Fees: Some businesses in the area offer recurring services. If you’ve signed up for a membership, this could be a periodic billing.

- Online Purchases: If you made an online purchase from a retailer based in the shopping center, the charge might appear under this descriptor.

Understanding ‘Real Dudes Inc’ Charge on Credit Card

A charge from “Real Dudes Inc” on your credit card statement may be linked to a subscription, online purchase, or service you recently used, which could affect your monthly budget. This company could be involved in entertainment, gaming, or digital services. If you do not recognize the charge, review past transactions, check for recurring payments, and contact the merchant for clarification.

Resolving Disputes & Protecting Yourself Against Unauthorized Charges

To resolve the matter by contacting your credit card provider and managing your balance effectively. dispute the charge if it was charged by bridgepointe pus san.s or unauthorized charges, start by reviewing your statements and transaction details. If the charge is unfamiliar, contact the merchant for clarification. If fraudulent activity is suspected, report it to your bank or credit card issuer immediately. Enable transaction alerts, use strong passwords, and monitor your account regularly to safeguard against future unauthorized charges.

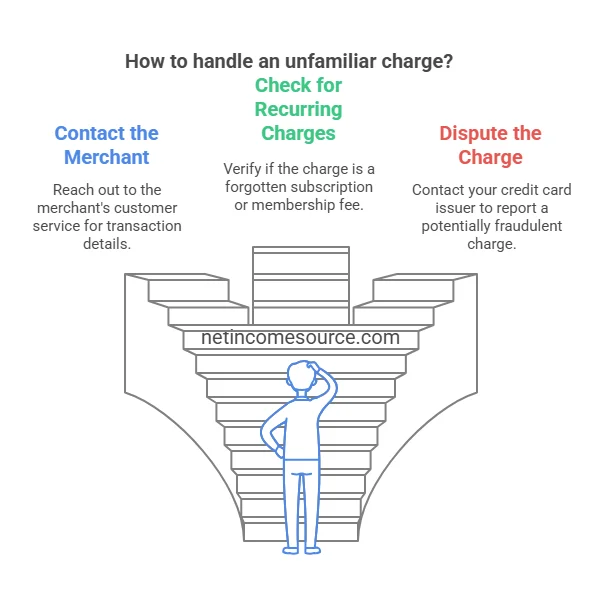

What to Do If You Don’t Recognize the Charge

If the charge on your credit card If the discrepancy seems unfamiliar, follow these steps to report the expense to your credit card provider. unauthorized charge resolve the issue:

- Review Your Recent Transactions to manage your spending and avoid any unexpected charges that could impact your financial information.: Check your receipts, emails, or credit card statement to see if the charge matches a recent transaction related to bridgepointe purchase.

- Contact the MerchantReach out to the consumer service to clarify any charges that seem unfamiliar. customer solution and service team of the business where you believe the charge originated. They can provide details about the transaction.

- Check for Recurring Charges: If the charge is recurring, ensure it’s not a subscription or membership fee you may have forgotten about.

- Dispute the Charge: If you’re certain the charge is fraudulent, contact your credit card issuer immediately. Most credit card companies have fraud protection policies and will investigate the issue.

Tips to Avoid Unfamiliar Charges

- Monitor Your Statements: Regularly check your credit card statement for any discrepancies or unauthorized charges. to catch any Discrepancy in your account can lead to questions about your overall balance. early.

- Keep Receipts: Save bills for all purchases, both online and in-store, to make it easier to verify transactions.

- Use Alerts: Set up alerts with your credit card provider for any unusual activity using your card. transaction alerts with your credit card company to receive notifications for every purchase.

- Secure Your Information: Protect your credit card information, especially when using your credit card by using secure websites and avoiding sharing details unnecessarily.

Some customer experiences with this charge and how they resolve it

1. Emily Johnson

Address: 1234 Elm Street, San Mateo, CA 94401

Experience:

Emily noticed a $75 charge labeled “Bridgepointe PUS San Mateo, CA” on her credit card statement. She didn’t recall making a purchase at the Bridgepointe Shopping Center recently. After reviewing her receipts, she realized she had bought a pair of shoes from a store in the center but forgot to save the receipt. Emily contacted the store’s customer service team, provided the transaction details, and confirmed the charge was legitimate. She now keeps all her receipts to avoid confusion in the future.

2. Michael Rodriguez

Address: 5678 Oak Avenue, Redwood City, CA 94061

Experience:

Emily noticed a $75 charge labeled “Bridgepointe PUS San Mateo, CA” on her credit card statement. She didn’t recall making a purchase at the Bridgepointe Shopping Center recently. After reviewing her receipts, she realized she had bought a pair of shoes from a store in the center but forgot to save the receipt. Emily contacted the store’s customer service team, provided the transaction details, and confirmed the charge was legitimate. She now keeps all her receipts to avoid confusion in the future.

3. Sarah Thompson

Address: 9101 Pine Lane, Foster City, CA 94404

Experience:

Sarah was surprised by a recurring $29.99 charge labeled “Bridgepointe PUS San Mateo, CA” on her credit card statement. She contacted her credit card issuer to investigate and discovered it was a subscription fee for a fitness class she had signed up for at a gym near the shopping center. Sarah decided to cancel the subscription and now reviews her statements more carefully to avoid unexpected billing.

4. David Lee

Address: 2468 Maple Drive, Belmont, CA 94002

Experience:

David noticed a $50 charge on his credit card and decided to pay closer attention to his recent transactions. credit card statement that he didn’t recognize. He hadn’t shopped at the Bridgepointe Shopping Center Recently, so he contacted the consumer service for assistance regarding the charge. customer service team of a restaurant he had visited in the area. They confirmed the charge was for a meal he had enjoyed with his family, which was within his planned budget period. To prevent future confusion, David started keeping digital copies of his receipts.

5. Linda Martinez

Address: 1357 Cedar Road, San Carlos, CA 94070

Experience:

Linda was alarmed by a $200 charge labeled “Bridgepointe PUS San Mateo, CA” on her credit card statement. She hadn’t made any large purchases recently and suspected fraudulent activity. Linda immediately contacted her credit card issuer to dispute the charge. The issuer investigated and determined the charge was unauthorized. They removed the charge from her account and issued her a new card to prevent further issues. Linda now monitors her statements weekly and uses transaction alerts to stay informed.

6. James Carter

Address: 3698 Birch Street, Menlo Park, CA 94025

Experience:

James saw a $45 charge on his credit card statement and couldn’t recall what it was for. After reviewing his recent activities, he remembered buying a gift card from a store in the Bridgepointe Shopping Center. He contacted the store’s customer service to confirm the transaction and was reassured it was legitimate. James now keeps a spending journal to track his purchases, manage his expenses, and avoid confusion.

| Key Takeaways from These Experiences | Details |

|---|

| Review your statements regularly | Many customers resolved concerns by carefully checking their credit card statements and receipts. |

| Contact the merchant | Reaching out to the business where the charge originated often provides clarity. |

| Use alerts and monitoring tools | Setting up transaction alerts with your credit card company helps you stay informed about every purchase. |

| Dispute unauthorized charges | If you suspect fraudulent activity, contact your credit card issuer immediately to resolve the issue. |

FAQs for Bridgepointe Pus san mateo ca charge on credit card

Why do I see a charge from Bridgepointe PUS San Mateo, CA on my credit card?

This charge typically comes from a purchase made at the their Shopping Center in San Mateo, California. It could be linked to a retail store, restaurant, or service provider located there.

What does ‘PUS’ stand for in the charge description?

“PUS” may refer to Point of Sale (POS) or Payment Utility Service, indicating that the charge originated from a transaction within the shopping center.

How can I verify if this charge is legitimate?

Check your bills, credit card statement, and emails for any related purchases. If you still don’t recognize the transaction, contact the merchant for more details about your due date and billing cycle.

What should I do if I did not make this purchase?

If you suspect an unauthorized charge, contact your credit card issuer immediately to dispute the charge and prevent further fraudulent activity.

Can I prevent unauthorized transactions on my credit card?

Yes. Set up transaction alerts, regularly checking your credit score check your credit card statement, and secure your credit card information to reduce the risk of fraudulent activity and maintaining peace of mind, make your minimum payment on time. credit card charges.

How can I dispute an unfamiliar charge?

To resolve an unfamiliar charge, contact your credit card company and provide details about the transaction. They will investigate and determine if a refund or chargeback is necessary.

San Mateo Credit Union 24-Hour Customer Service

San Mateo Credit Union does not offer 24-hour customer service, but you can reach them during their business hours for assistance. For after-hours support, check their website for online banking options or call their automated phone service.

Can I return items purchased from Bridgepointe Plaza, San Mateo, CA, using your credit card?

Return policies depend on the specific store where you made the purchase. Most stores at Bridgepointe Plaza have their own return policies, which may require a bill and have time limits. It’s best to check with the retailer directly.

Is It Safe to Shop at Bridgepointe Plaza, San Mateo, CA?

Yes, Bridgepointe Plaza is a well-maintained shopping center with a variety of stores and restaurants. It has security measures in place, and shopping there is generally safe. As with any public place, stay aware of your surroundings.

What Is 2207 Bridgepointe Plaza?

2207 Bridgepointe Plaza is a specific address within the shopping center in San Mateo, CA. It may refer to a store, office, or business location. If you need details, check with the property management or the business at that address.

Final Thought

Navigating unfamiliar charges like “Bridgepointe PUS San Mateo, CA” on your credit card statement can feel overwhelming, but proactive steps can bring clarity and peace of mind. By regularly monitoring your transactions, keeping records, and promptly addressing discrepancies, you empower yourself to maintain control over your finances. Whether it’s a legitimate purchase from a bustling shopping center or a red flag for unauthorized activity, staying vigilant ensures your hard-earned money remains secure. Take charge of your financial story—because every transaction tells a part of it.

Disclaimer

The information provided in this article, “Understanding the ‘Bridgepointe PUS San Mateo, CA’ Charge on Credit Card Statement,” is intended for general informational purposes only. It is not financial or legal advice. While we strive to offer accurate and up-to-date details, transaction descriptors and their meanings may vary based on individual circumstances, credit card providers, or merchants. Readers are encouraged to verify charges directly with their credit card issuer or the relevant merchant for clarification. The experiences shared are fictional examples created for illustrative purposes and do not represent real individuals or events. For specific concerns about your credit card statement or potential unauthorized charges, please consult your financial institution or a qualified professional. The author and publisher are not responsible for any actions taken based on this content.

More unfamiliar charges on credit card you need to know

- Is the AMDB Charge on Your Credit Card Legit? Here’s What to Know

- Understanding the El Cerrito Berkeley CA Charge on Credit Card in 2025

- Understanding the El Cerrito Berkeley CA Charge on Credit Card

- Understanding 1600 Amphitheatre Parkway Credit Card Charges

0 Comments on “Understanding the “Bridgepointe PUS San Mateo, CA” Charge on Credit Card Statement”