Revel Credit Card: No. 1 Rewards Card

Hey guys, we’ll talk about how to use a Revel credit card. In the world of credit cards, where options seem boundless, the Revel Credit Card stands out as a beacon of financial empowerment. With its array of benefits and features designed to optimize user experience and financial well-being, the Revel Credit Card is not just another piece of plastic in your wallet; it’s a strategic financial tool that can revolutionize the way you manage your finances.

Understanding the Revel Credit Card

Features

The Revel Credit Card boasts a plethora of features tailored to meet the diverse needs of modern consumers. From cashback rewards to travel perks, this card offers a comprehensive suite of benefits that cater to both everyday expenses and aspirational indulgences.

Cashback Rewards Program

At the heart of the Revel Credit Card lies its lucrative cashback rewards program. With every purchase, cardholders earn a percentage of their spending back in the form of cash rewards. This incentivizes responsible spending while simultaneously providing tangible financial benefits.

Travel Benefits

For the globetrotters and jet-setters among us, the Revel Credit Card offers an array of travel benefits that elevate the travel experience to new heights. From complimentary airport lounge access to travel insurance coverage, this card ensures that every journey is not just a destination but an experience to be savored.

Financial Flexibility

In addition to its rewards and perks, the Revel Credit Card also offers unparalleled financial flexibility. With features such as low APR rates and flexible payment options, cardholders can navigate their financial landscape with confidence and ease.

How to Apply

Applying for the Revel Credit Card is an easy process that can be completed online in a matter of minutes. Simply visit the official Revel website, fill out the secure application form, and await approval. Once approved, your Revel credit card will be shipped directly to your doorstep, ready to unlock a world of financial possibilities.

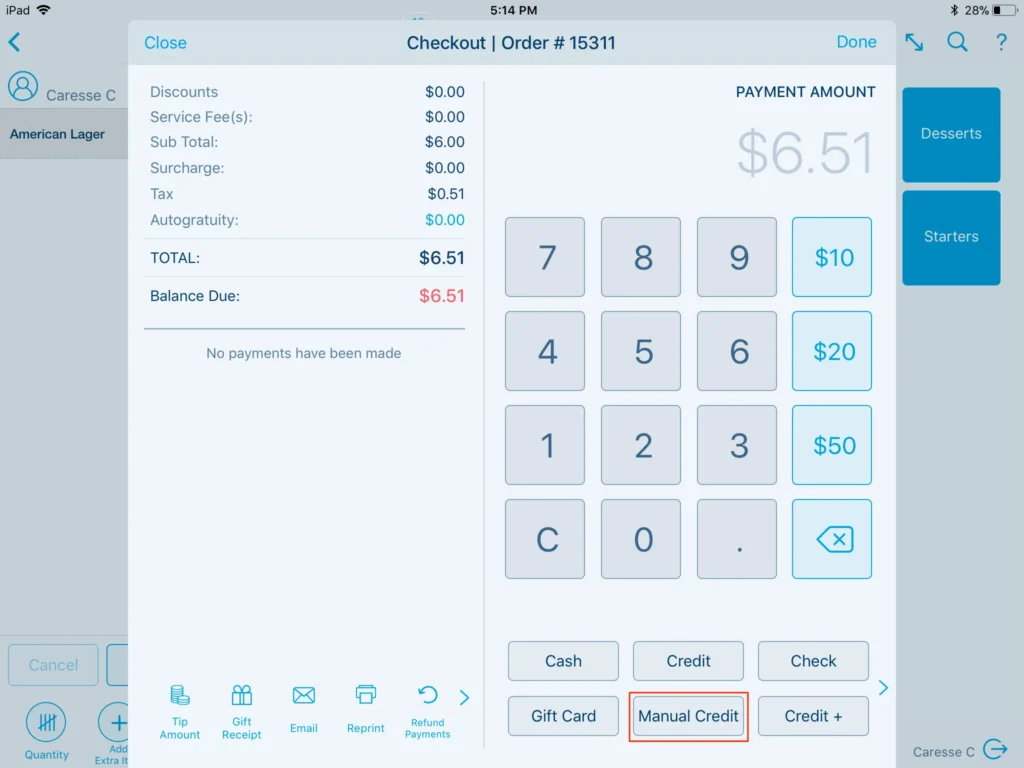

how to use Revel credit:

Revel credit can be earned through referrals or promotions. It can be used to pay for your next Revel moped or ride-chair trip, but it needs to be used within 90 days of redemption; otherwise, it will expire.

Here’s how to use Revel credit:

- Launch the Revel app on your phone and log in to your account.

- Tap on the menu button located on the top left corner of the screen.

- Go to your profile section.

- Tap on the payment method option.

- Scroll down the list and tap on the promo code.

- Select the option to redeem a promo code.

- Enter the code and tap on redeem promo code.

- The discount will be automatically applied to your upcoming Revel rides.

Keep in mind that Revel credit cannot be used to tip drivers or to waive cancellation or no-show fees.

Conclusion

In conclusion, the Revel Credit Card is not just a financial instrument; it’s a gateway to financial empowerment and prosperity. With its robust rewards program, unparalleled benefits, and user-friendly interface, this card is poised to revolutionize the way you think about credit. Don’t just settle for the ordinary; embrace the extraordinary with the Revel Credit Card. Apply today and embark on a journey towards financial freedom.

Also: Top Fintech Credit Cards of 2024 : Unlock the Ultimate Rewards

Related FAQ’s

What is Revel credit?

Revel credit is a discount applied to your ride fare that can be earned through referrals or promotions.

How can I earn Revel credit?

There are two ways to earn Revel credit:

Referrals: Refer friends to Revel, and you may earn credit when they sign up and take their first ride.

Promotions: Revel may offer promotions from time to time that include Revel credit as a reward.

Can I use Revel credit to waive cancellation or no-show fees?

No, Revel credit cannot be used to waive cancellation or no-show fees.

How can I check my cashback balance?

To check your cashback balance with the Revel Credit Card, simply log in to your online account on the Revel website or mobile app. From there, navigate to the rewards or account summary section where you should find detailed information about your cashback balance.

What should I do if my card is lost or stolen?

If your Revel credit card is lost or stolen, it’s crucial to act quickly to protect yourself from unauthorized charges. Immediately contact Revel Credit Card’s customer support hotline, which is available 24/7, to report the loss or theft. They will guide you through the process of canceling your old card and issuing a new one.

Can I transfer my rewards to another account?

Yes, the Revel Credit Card offers the flexibility to transfer your accumulated rewards to another account. Simply contact Revel’s customer service and request a rewards transfer. They will assist you in completing the transfer securely and efficiently.

How do I upgrade my card?

If you’re interested in upgrading your Revel Credit Card to a higher tier with enhanced benefits, reach out to Revel’s customer service team. They will provide you with detailed information about available upgrade options and guide you through the upgrade process.

Are there any foreign transaction fees?

No, one of the perks of using the Revel Credit Card is that it does not charge any foreign transaction fees. Whether you’re traveling abroad or making purchases in foreign currencies online, you can enjoy the convenience of using your Revel Credit Card without worrying about additional fees.

0 Comments on “Revel Credit Card: No. 1 Rewards Card”