Registration Loans in AZ Fast Cash Loans on Car Titles & More

Get fast cash with registration loans and title loans in AZ. Apply online today for quick approval and keep driving your vehicle while you borrow! For individuals facing sudden financial strain and seeking immediate access to cash, registration loans may serve as an effective solution using your vehicle as collateral. Unlike traditional personal loans or installment loans that involve lengthy approval processes and stringent credit requirements, registration loans offer a quick and accessible alternative. By using a vehicle’s registration as collateral—without the need to surrender the keys or the car title—borrowers can secure fast cash without significant disruption to their daily lives. Here is an in-depth overview of how registration loans work, their advantages, and what applicants need to know.

What Are Registration Loans?

A registration loan is a short-term secured loan that uses a vehicle’s registration as collateral. Unlike a title loan, which requires full ownership of the vehicle and submission of the car title, a registration loan only requires that the vehicle is registered in the borrower’s name—even if there are outstanding payments on the vehicle. Throughout the loan period, the borrower retains full access to and use of the vehicle.

Registration loans in AZ are particularly popular in states like Arizona, where they provide financial relief to individuals with poor credit or limited credit histories. Lenders evaluate a borrower’s ability to repay based on income and the vehicle’s registration, making these loans accessible to a broader range of applicants.

How Do Registration Loans Work?

The process of obtaining a registration loan is straightforward and designed for speed. The typical steps include:

- Application: Applicants can apply either online or in person by providing personal details and vehicle information.

- Document Submission: Required documents generally include the vehicle’s registration, a government-issued ID, proof of income (such as pay stubs), and occasionally proof of residency or insurance for loan approval.

- Assessment: Financial institutions will evaluate your application based on the value of your car. The lender assesses the vehicle registration and evaluates the vehicle’s value to determine the loan amount for the loan online application.

- Disbursement: Upon approval, the borrower receives the loan funds—often on the same day. Some lenders can provide cash within as little as 30 minutes.

Throughout the loan term, borrowers continue driving their vehicles, making registration loans a convenient financing option.

Differences Between Registration Loans and Car Title Loans

Understanding the distinction between registration loans and car title loans is essential when selecting the right option:

- Ownership Requirement: Car title loans require full ownership of the vehicle and the physical title as collateral. Registration loans, on the other hand, only require that the vehicle is registered in the borrower’s name, even if the car is still financed.

- Collateral Type: Title loans utilize the vehicle title as collateral, while registration loans leverage the vehicle’s registration.

- Eligibility: Registration loans offer broader eligibility since borrowers do not need to own their vehicles outright.

For borrowers who are still making car payments, registration loans provide a more accessible solution compared to title loans.

Also read: Grace Loan Advance: How to Secure Fast Personal Loans Online

Similarities Between Car Title and Registration Loans

While they differ in structure, registration loans and car title loans share several key features:

- Vehicle-Based Collateral is a key aspect of registration loans, allowing borrowers to secure funds against their auto title. Both loan types use the vehicle as a form of security, particularly in the state of Arizona where car registration loans are popular.

- Minimal Credit Requirements: Lenders typically do not perform strict credit checks, making these loans suitable for individuals with bad credit.

- Fast Funding: Both options are designed to provide immediate cash, often within hours of application.

These similarities make both loan types attractive for those seeking the cash you need for fast financial relief.

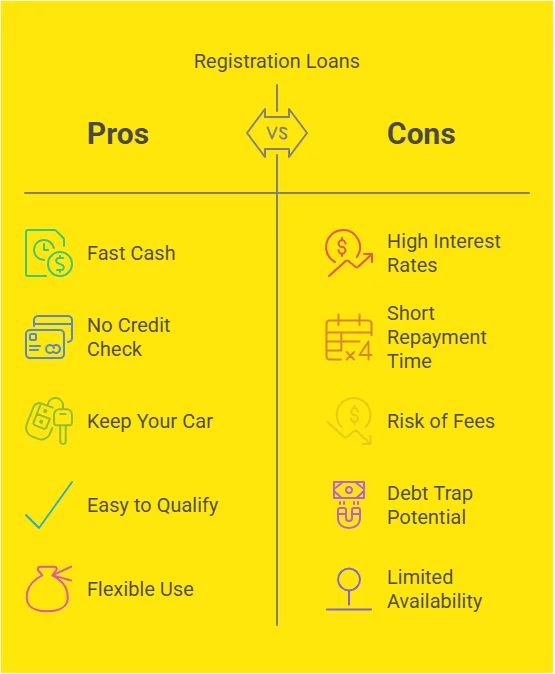

Benefits of Registration Loans

Several factors make registration loans a favorable option for individuals facing short-term financial challenges:

- No Credit Check: Lenders prioritize vehicle registration and income over credit scores.

- Vehicle Retention: Borrowers can continue using their vehicles while repaying the loan.

- Quick Access to Funds: You can get the cash you need through registration loans and title loans. Many lenders disburse loan proceeds within hours of approval.

- Flexible Eligibility criteria make it easier for borrowers to qualify for cash title loans. Borrowers who do not fully own their vehicles can still qualify, provided the registration is in their name.

In Arizona, companies such as AZ Auto Lenders streamline the process further by offering online registration loans and expedited approval.

Registration Loan Requirements

To qualify for a registration loan, applicants typically need to provide the following:

- A vehicle with registration in their name

- Proof of income to demonstrate repayment ability is crucial for loan approval.

- A valid government-issued ID is often required to secure cash title loans.

- Proof of residency (e.g., utility bill)

- Proof of insurance (in some cases)

Even if the vehicle is not fully paid off, borrowers may still be eligible, distinguishing registration loans from title loans that require full ownership.

Also try: Ultimate Guide to Shopping Center Financing: Secure Construction Loans and Maximize Profit

Registration Loan Timeline

Speed is a defining feature of registration loans. The process usually follows this timeline:

- Application: Takes only a few minutes, either online or in person, to complete the registration loan online application.

- Approval for cash loans can depend on various factors, including your income and the value of your car. Lenders typically review and approve applications within 30 to 60 minutes, depending on document submission and the value of your car.

- Funding: Once approved, borrowers often receive same-day funding, sometimes within 30 minutes.

For those in urgent need of cash, lenders like AZ Auto Lenders in Arizona provide efficient cash loans solutions.

Considerations and Potential Risks

While registration loans offer quick access to cash, prospective borrowers should be aware of the associated risks of cash title loans:

- High Interest Rates: These loans often carry elevated APRs.

- Short Repayment Terms: Borrowers may have only a few weeks to repay, with penalties for late payments.

- Default Risks: Failure to repay can result in additional fees and, in some cases, affect vehicle ownership status.

- Debt Cycle Risk: Rolling over loans can lead to escalating debt.

It is crucial to review the loan terms carefully and borrow only what can reasonably be repaid.

Who Should Consider a Registration Loan?

Registration loans are ideal for individuals who:

- Own a vehicle registered in their name to qualify for a car registration loan.

- Have a steady income but face credit challenges

- Require immediate cash to cover emergency expenses, which can be addressed through loans in Phoenix, AZ.

- Need a fast alternative to traditional bank loans? Consider a car registration loan for the money you need.

For those seeking larger loan amounts or longer repayment terms, personal loans may be more suitable.

How to Apply for a Registration Loan

To get started with a registration loan, applicants should follow these steps to ensure timely payments on time.

- Select a Trusted Lender: Choose a reputable lender with transparent terms and proper licensing, such as AZ Auto Lenders in Arizona.

- Prepare Documentation: Gather required documents, including vehicle registration, identification, and proof of income.

- Submit an Application: Apply online or visit a physical branch to expedite your loan approval process.

- Review Loan Terms carefully before committing to any registration loans in AZ. Ensure clarity on loan amounts, fees, and repayment conditions.

- Receive funds quickly at the end of the loan process, allowing you to address your financial needs. Upon approval, the borrower can access the funds promptly.

AZ Auto Lenders, for instance, provides competitive rates, flexible terms, and efficient service to meet borrowers’ financial needs.

Final Thoughts

When urgent financial needs arise, registration loans can offer a practical and fast solution to get the cash. While not a long-term financial strategy due to high interest rates and short repayment terms, these loans can bridge temporary financial gaps without requiring borrowers to forfeit their vehicles. Responsible borrowing, paired with a trusted lender, ensures that a registration loan remains a helpful resource rather than a financial burden.

For those ready to explore registration loan options, companies like AZ Auto Lenders make the process of getting the cash simple, secure, and quick. Applying online today can provide the cash needed to navigate financial challenges—swiftly and effectively.

FAQs about registration loans

Why are Registration Loans Only Available in Arizona?

Registration loans are unique to Arizona because state laws allow lenders to use your vehicle’s registration as collateral without requiring full ownership, unlike most states that stick to title loan rules.

How Many Registration Loans Can You Have?

You can typically only have one registration loan at a time per vehicle, as lenders use your car’s registration as security, and it can’t be tied to multiple loans simultaneously.

What Do I Need for a Registration Loan?

You’ll need your vehicle registration, a valid ID, proof of income (like pay stubs), and sometimes proof of residency or insurance—simple stuff to show you and your car qualify.

What Happens If You Don’t Pay a Registration Loan in Arizona?

If you don’t pay, you’ll face late fees, higher interest, and possibly a hit to your credit. In extreme cases, the lender could take legal action, but they can’t seize your car like with a title loan.

How Much Can I Get for a Registration Loan in Arizona?

Loan amounts depend on your vehicle’s value and your income—usually ranging from $100 to $2,500, though some lenders might offer more based on your situation, especially in loans vs traditional bank loans.

Can I Use My Registration for a Title Loan?

No, a title loan requires your car’s title, not just the registration. Registration loans are different because they don’t need full ownership, while title loans do.

Does TitleMax Do Registration Loans Near Me, and how do they compare to other financial institutions?

TitleMax focuses on title loans, not registration loans. You’d need to check with local Arizona lenders like Cash Time or others that specialize in registration loans.

Can a Loan Account Be Transferred to Another Branch?

It depends on the lender’s policy. Some allow transfers between branches for convenience, but you’ll need to ask your specific lender to confirm.

Can I Get a Registration Loan Without a Bank Account?

Yes, many lenders don’t require a bank account—just proof of income. You might get cash directly or a prepaid card instead of a bank deposit.

Can I Have Multiple Registration Loans?

Generally, no—lenders tie one loan to one vehicle registration. You’d need a second vehicle with its own registration to get another loan.

Can You Get a Title Loan with the Car Registration?

Nope, title loans need the actual car title, not just the registration. Registration loans are a separate option for those who don’t own their car outright.

What If I Have Bad Credit, Can I Still Get a Registration Loan from Cash Time?

Absolutely! Registration loans and title loans offer a viable option for quick funding. You can get the money you need quickly through a car registration loan. Cash Time and similar lenders don’t focus on your credit score—just your vehicle registration and income—so bad credit won’t stop you.

Disclaimer:

The information in this article is for general guidance only and isn’t financial or legal advice. Registration loans vary by lender, location, and individual circumstances, so terms, rates, and eligibility may differ. Always review loan agreements carefully and consult a financial professional before borrowing. We’re not responsible for decisions made based on this content—proceed at your own risk.

You also loves to read

- Green Dollar Loans Review: Same-Day Loans in USA

- The Ultimate Guide to Bad Credit Loans with Guaranteed Approval

- Tapping Wealth: Unlocking the Power of Home Loan Equity with Alpine Credits

- Get The best small personal loan with poor credit score

- CUP Loan program Everything You Need to Know in 2025

0 Comments on “Registration Loans in AZ Fast Cash Loans on Car Titles & More”