1.Tapping Wealth: Unlocking the Power of Home Loan Equity with Alpine Credits

for over 50 years alpine credits has been the pioneer in the private lending industry we’ve been helping tens of thousands of Canadian homeowners get home equity loans when they need it we provide homeowners in ontario british columbia and Alberta with a variety of financing options that are best suited to their needs whether you’re looking for some additional funds for home renovations debt consolidation credit repair starting a new business or investing in an existing business.

Table of Contents

- Introduction

- What is Home Loan Equity?

- Benefits of Home Loan Equity

- How to Tap into Home Loan Equity with Alpine Credits

- Step 1: Determine Your Home Loan Equity

- Step 2: Evaluate Your Financial Needs

- Step 3: Apply for a Home Equity Loan or Mortgage

- Step 4: Utilize Your Funds Wisely

- Tips for Maximizing the Benefits of Home Loan Equity

- Tip 1: Start with a Clear Financial Goal

- Tip 2: Create a Realistic Budget

- Tip 3: Explore Multiple Lenders

- Tip 4: Consult a Financial Advisor

- Potential Risks to Consider

- Conclusion

2.Introduction

Are you looking to tap into the wealth hidden within your home? With the help of Alpine Credits, you can unlock the power of home loan equity and put it to work for your financial well-being. In this comprehensive guide, we will explore what home loan equity is, the benefits it offers, and how you can make the most of it with the assistance of Alpine Credits. Whether you have a specific financial goal in mind or are simply curious about leveraging your home’s value, this guide is here to provide you with valuable insights and actionable steps.

3.What is Home Loan Equity?

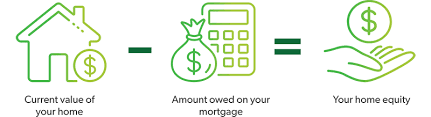

Home loan equity refers to the portion of your home’s value that you truly own, equity being the difference between the market value of your property and the outstanding balance on your mortgage. As you make mortgage payments and your property’s value appreciates, your equity increases. This equity can then be accessed through various financial products, allowing you to use it for other purposes such as home renovations, consolidating debt, or investing in additional properties.

4.Benefits of Home Loan Equity

Tapping into your home loan equity can unlock a range of benefits, including:

- Access to Large Amounts of Capital: By leveraging the equity built up in your home, you can gain access to larger amounts of capital than you might otherwise be eligible for through traditional means.

- Lower Interest Rates: Home equity loans or mortgages typically offer lower interest rates compared to unsecured loans, making them a more affordable financing option.

- Flexible Repayment Terms: Home equity loans provide greater flexibility in terms of repayment schedules, allowing you to choose a plan that aligns with your financial circumstances and goals.

- Potential Tax Advantages: Depending on your jurisdiction, the interest paid on a home equity loan or mortgage may be tax-deductible, providing potential tax benefits.

- Opportunity for Wealth Creation: By utilizing your home loan equity wisely, you have the opportunity to create additional wealth through investments or property value appreciation.

Now that we have established the benefits of home loan equity, let’s explore how you can tap into this valuable resource with the help of Alpine Credits.

5.How to Tap into Home Loan Equity with Alpine Credits

Alpine Credits is a trusted lender that specializes in providing flexible and convenient home equity loans or mortgages. By following these steps, you can make the most of your home loan equity:

Step 1: Determine Your Home Loan Equity

Before proceeding with any financial decisions, it is essential to determine your home loan equity. You can do this by subtracting the outstanding balance on your mortgage from the current market value of your property. Alpine Credits can assist you in accurately assessing your equity.

Step 2: Evaluate Your Financial Needs

Next, take the time to evaluate your financial needs and goals. Determine how much equity you would like to access and what you intend to do with the funds. Having a clear understanding of your financial objectives will enable you to make informed decisions throughout the borrowing process.

Step 3: Apply for a Home Equity Loan or Mortgage

Once you have a firm grasp of your equity and financial needs, it’s time to apply for a home equity loan or mortgage with Alpine Credits. Their experienced team will guide you through the application process, ensuring you receive competitive rates and terms tailored to your unique situation.

Step 4: Utilize Your Funds Wisely

After securing your home equity loan or mortgage, it’s crucial to utilize the funds wisely. Whether you plan to renovate your home, consolidate debt, or invest in additional properties, careful financial planning will help you make the most of your borrowed funds. Consider consulting a financial advisor to ensure you are making informed decisions.

7.Tips for Maximizing the Benefits of Home Loan Equity

To maximize the benefits derived from tapping into your home loan equity, consider these helpful tips:

Tip 1: Start with a Clear Financial Goal

Defining a clear financial goal before accessing your home loan equity is essential. Whether it’s improving your home, funding your children’s education, or growing your investment portfolio, having a specific objective will help guide your borrowing and spending decisions.

Tip 2: Create a Realistic Budget

Before you start spending your borrowed funds, create a realistic budget that outlines your expenses and financial obligations. This will ensure you stay on track and make the most of your home loan equity without jeopardizing your financial stability.

Tip 3: Explore Multiple Lenders

While Alpine Credits is a reputable lender, it’s always beneficial to explore multiple lenders and compare their offers. Shopping around for the best rates and terms will help you secure the most favorable financing arrangement for your needs.

Tip 4: Consult a Financial Advisor

If you’re new to home loan equity borrowing or have complex financial goals, consider seeking advice from a professional financial advisor. They can provide tailored guidance based on your unique circumstances, helping you maximize the potential benefits and mitigate risks.

8.Potential Risks to Consider

While tapping into your home loan equity can be advantageous, it’s crucial to be aware of potential risks. Some risks associated with utilizing home loan equity include:

- Debt Accumulation: Borrowing against your home can lead to increased debt if not managed carefully. Ensure you have a repayment plan in place and avoid using the funds for non-essential expenses.

- Fluctuating Property Values: Property values can fluctuate, resulting in a potential decrease in your equity over time. Keep an eye on the real estate market and make informed decisions accordingly.

- Additional Costs: Home equity loans or mortgages may come with additional costs such as origination fees, appraisal fees, and legal fees. Consider these costs when evaluating the overall affordability of borrowing against your home.

By understanding these risks and making informed choices, you can mitigate potential drawbacks and make the most of your home loan equity.

What is home loan equity, and how is it different from the home’s value?

Home loan equity is the difference between your home’s current market value and the outstanding mortgage balance. It represents the portion of your property that you truly own. This is distinct from the home’s value, which is the total estimated worth of the property in the current market.

How does Alpine Credits determine eligibility for a home equity loan?

Alpine Credits determines eligibility for a home equity loan based on specific criteria. This includes factors such as the value of your home, existing mortgage balance, and your creditworthiness. Meeting these criteria increases the likelihood of approval.

What are the potential drawbacks of tapping into home equity

Potential drawbacks of tapping into home equity include the risk of increasing debt and the possibility of facing financial challenges if property values decrease. It’s crucial to carefully consider these factors before deciding to use home equity.

Are there tax implications associated with using home loan equity

Tax implications may be associated with using home loan equity. Interest paid on home equity loans is often tax-deductible, providing potential tax benefits. However, it’s advisable to consult with a tax professional to understand the specific implications in your situation.

How long does the application process with Alpine Credits typically take?

The application process with Alpine Credits typically takes a reasonable amount of time, but the exact duration can vary. Generally, the process involves assessing eligibility, submitting documentation, and approval. It’s recommended to inquire directly with Alpine Credits for specific timelines.

Conclusion

Tapping into your home loan equity with the guidance of Alpine Credits can be a powerful financial move. By understanding what home loan equity is and how it can benefit you, you can leverage this hidden wealth to achieve your financial goals. Remember to assess your equity, evaluate your financial needs, apply for the right loan or mortgage, and utilize your funds wisely. The tips provided in this guide will help you make informed decisions and extract maximum value from your home loan equity. Don’t hesitate to consult a financial advisor and take advantage of the expertise provided by Alpine Credits. Start tapping into your wealth today and secure a brighter financial future.

Note: This blog post is for informational purposes only and should not be considered as financial advice. Please consult with a professional financial advisor before making any financial decisions.

share

0 Comments on “1.Tapping Wealth: Unlocking the Power of Home Loan Equity with Alpine Credits”