Tims credit card: Is the Tim Hortons Coffee card Available to Earn in 2025

Is a Tims credit card available? Explore if a Tim Hortons coffee card earns Tims Rewards Points! Discover if a Tims Mastercard can earn 5 points per $1. If you’re a Canadian who can’t start the day without a Tim Hortons double-double, the Tims Credit Card is available and might catch your eye. Issued in partnership with Tangerine, this no-annual-fee card is designed for Tims fans, offering rewards tailored to frequent coffee and donut runs. But is it the right fit for your wallet? This user-friendly review breaks down the card’s features, benefits, drawbacks, and who it’s best for, with a focus on helping you decide if it’s worth the application.

What Is the Tim Hortons Credit Card?

The Tims Credit Card is a co-branded Visa card that lets you earn 5 points per dollar on every purchase, with a higher earn rate at Tim Hortons locations, providing powerful financial tools to manage your spending. You can redeem these points for free coffee, baked goods, or other menu items at Tim Hortons across Canada, including ways to earn more free Tims Rewards points everywhere. With no annual fee and a simple rewards structure, it’s an accessible option for loyal customers, but its niche focus might not suit everyone.

Key Features

- No Annual Fee, making it an attractive option for the new Tims credit card, especially for Canadians looking for a rewards card. Enjoy rewards without paying yearly fees, perfect for budget-conscious users looking for a version of the Tims credit that suits their needs.

- Welcome Bonus: Earn 1,500 bonus points after spending $200 within the first three months (terms apply).

- Flexible Redemption options are available for Canadians who can apply for the Tims rewards card.: Redeem points for free menu items at Tim Hortons, with no blackout dates.

- Visa Perks: The Tims Credit Card is issued under the division of Tim Hortons established to give Canadians more financial options.: Includes zero liability for unauthorized transactions and emergency card replacement.

- Cash Advance Interest Rate may apply, so it’s important to manage your spending through the Tims rewards card.: Typically around 20% or higher, which applies to cash advances (check terms for exact rates).

- Low Credit? The Tims Mastercard may be the perfect solution for you. No Credit History? The Tim Hortons credit card is available for individuals like students and newcomers. You Can Earn Points with the Secured Card, which is available to Canadians seeking to manage their everyday finances!: A secured version is available for those with low or no credit history, allowing you to build credit while earning rewards.

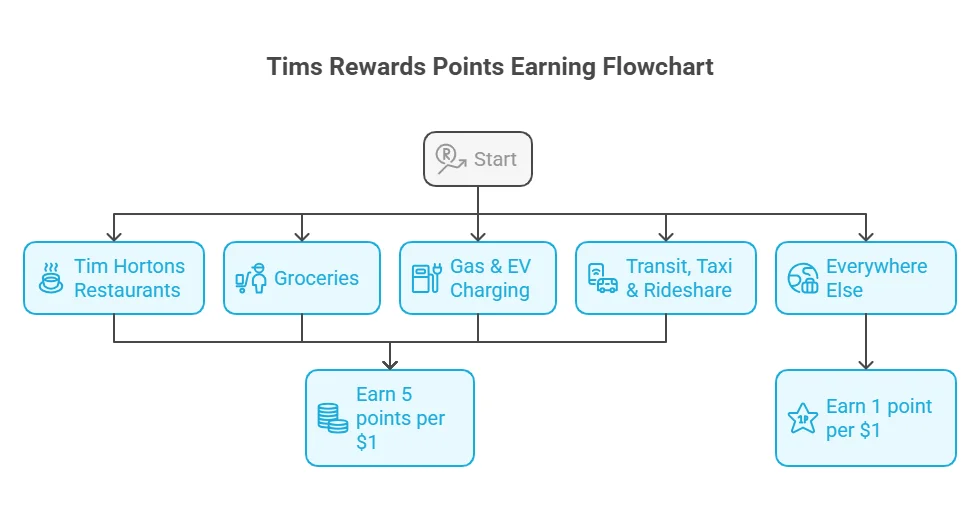

Earn 5 Tims Rewards Points per $1 on Everyday Essentials

The card’s rewards program is designed to maximize value on daily spending, allowing users to build their credit history. Here’s how you earn:

- Tim Hortons Restaurants are the perfect place to earn Tims Rewards points.: Earn 5 points per $1 Earn Tims Rewards points on all in-store, drive-thru, or app purchases at Tim Hortons to enjoy free Tim Hortons coffee.

- Groceries can help you earn points per dollar on groceries, enhancing your rewards.: Earn 5 points per $1 at grocery stores, helping you rack up rewards on weekly shopping.

- Gas & EV Charging: Earn 5 points per $1 on fuel purchases and electric vehicle charging stations.

- Transit, Taxi & Rideshare: Earn 5 points per $1 on public transit, taxi services, and rideshare apps like Uber or Lyft.

- Everywhere Else, including the division of Tim Hortons, Canadians can apply for special offers.: Earn 1 point per $1 on all other eligible purchases, allowing for a more versatile rewards experience with the Tims rewards card.

Key Features

- No Annual Fee: Enjoy rewards without worrying about yearly costs, making it budget-friendly for the new Tims credit card.

- Rewards Program: Earn 5 Tim Rewards points per $1 spent at Tim Hortons and can lead to faster access to more free coffee. 1 point per $1 on all other purchases, cardholders earn points that can be redeemed for Tims menu items.

- Welcome BonusNew cardholders can score 15 points on all eligible purchases at a Tim Hortons. 1,500 bonus points after spending $200 within the first three months (terms apply).

- Flexible Redemption: Redeem points for free menu items like coffee or donuts at any Tim Hortons location, with no blackout dates, providing a great way to earn Tims Rewards.

- Visa Perks: Includes standard benefits like zero liability for unauthorized transactions and emergency card replacement.

Pros of the Tim Hortons Credit Card

- High Rewards at Tims: The 5 points per $1 at Tim Hortons offers a solid return (roughly 3-5% based on redemption value), perfect for frequent visitors.

- No Annual Fee: A cost-free way to earn rewards, especially appealing for budget-conscious consumers.

- Easy-to-Use Rewards for earning Tims Rewards points everywhere, including at Tim Hortons and beyond.: The straightforward points system makes earning and redeeming rewards hassle-free.

- Welcome Bonus Value for those who apply for the card.: The 1,500-point bonus can cover multiple free beverages and food items, giving new users an immediate perk with the Tims credit card offers.

Cons of the Tim Hortons Credit Card

- Limited Redemption Options: Points are only redeemable at Tim Hortons, lacking the flexibility of cash back or travel rewards, making it less appealing for those with limited or no credit history, but it offers quicker ways to earn rewards on beverages.

- Low Non-Tims Rewards: Earning just 1 point per $1 on other purchases is less competitive than many no-fee cards, especially when compared to earning 5 points per dollar on groceries.

- Niche Appeal: If you don’t visit Tim Hortons often, the card’s value drops significantly.

- No Premium Perks, but the Tims Mastercard may still provide valuable rewards for everyday spending.: Lacks benefits like travel insurance or purchase protection, which are common in other card offers.

Who Should Get This Card?

This card offers a great fit for cardholders looking to earn more free Tim Hortons rewards.

- Tim Hortons Regulars: If you spend $50 or more monthly at Tims, the 5 points per $1 rate can lead to significant savings on your Tim Hortons coffee and snack habit.

- Budget-Conscious Shoppers: The no-annual-fee structure makes it a low-risk option for earning Tims Rewards points and allows you to earn 5 points per dollar.

- Canadians Seeking Simplicity: The easy redemption process and lack of complicated tiers appeal to those who want a straightforward card, especially when managed entirely through the Tim Hortons app.

It’s not ideal for those with limited or no credit history.

- Occasional Tims Visitors: If you rarely stop by Tim Hortons, the rewards won’t add up.

- Travel or Cashback FansThose who prefer flexible rewards or premium perks like travel insurance should look elsewhere; however, Canadians who apply for the Tims Credit Card can enjoy access to more free coffee.

- Balance Carriers for those looking to apply for the card.: The card’s high APR (typically 20% or more) could make carrying a balance costly, negating rewards, especially if you don’t pay within 30 days.

How to Maximize the Card’s Value

- Use It at Tims to enjoy the benefits of the Tims rewards card.: Always pay with the card at Tim Hortons to take advantage of the 5 points per $1 rate. For example, spending $5 daily could earn you 9,125 points annually, enough for 20+ free coffees.

- Hit the Welcome Bonus and earn 15 points per dollar spent after meeting the required spending threshold.: Spend $200 in the first three months to unlock the 1,500 bonus points on your new Tims credit card offers.

- Pair with the Tims App to track your points and redeem them for beverages and food.: Link the card to the Tim Hortons app to stack additional app-based offers and streamline payments for your new Tims credit card.

- Pay Off Monthly: Avoid interest charges by paying the full balance each month to keep the card cost-effective.

How It Compares to Other Cards

- Tangerine Money-Back Credit Card is a great tool to manage their everyday expenses.: Offers 2% cash back in two chosen categories (e.g., dining or groceries) and 0.5% on everything else, with no annual fee. It’s more versatile but doesn’t match the Tims-specific rewards rate.

- CIBC Dividend Visa CardEarns 4% cash back on gas and groceries, 2% on dining, and 1% elsewhere, making it a valuable card from Tims Financial with a $99 annual fee (often waived), which provides Canadians convenient and powerful financial tools. Better for diverse spending but less tailored to Tims fans.

- PC Optimum Mastercard: Provides 30 points per $1 at Loblaws stores and 10 points elsewhere, with no annual fee. Ideal for grocery shoppers but less rewarding for Tim Hortons purchases.

Application Process

Applying for the Tim Hortons Credit Card is simple:

- Visit the Tangerine website or app.

- Provide personal details (name, address, income, etc.) to apply for the neo financial services.).

- Undergo a credit check (no minimum income required).

- Get approved, often within minutes, and start using the card.

Tim Hortons Credit Card FAQs

What is the credit limit on a Tim Hortons Credit Card?

The credit limit varies based on your creditworthiness, income, and credit history – like students who are new to credit. For the standard Tims Mastercard, limits are determined after a credit check, and Canadians can apply even if they have no credit history. The secured version requires a deposit ($50–$10,000), which sets your limit. Contact Tims Financial for specifics.

How to apply for a Tims Credit Card to access convenient and powerful financial tools? The card is available online for easy access.

Download the Tim Hortons app from the App Store or Google Play, tap the Tims Financial icon, and submit your personal details (name, address, income). Approval is often instant, with a hard credit check for the standard card or a deposit for the secured version.

How to get a Tim Hortons Credit Card?

Apply through the Tim Hortons app or visit timsfinancial.ca to access financial tools to manage your spending effectively. You’ll need to be a Canadian resident of legal age in your province. Provide personal info, and for the secured card, a deposit. Once approved, add the virtual card to Apple/Google Wallet or wait for the physical card.

What are the benefits of the Tims Credit Card?

No annual fee, making it an attractive option for Canadian residents who have limited financial resources.

Earn 15 points per dollar at Tim Hortons (with app scan), 5 points per dollar on groceries, gas, EV charging, transit purchases, taxis, and rideshares, and 1 point per $2 elsewhere.

Welcome bonus: $20 Tims gift card after your first purchase within 30 days (until April 30, 2025).

Redeem points for Tims menu items or apply for a new Tims credit card to increase your earning potential with exclusive card offers.

Secured version helps build credit.

Includes extended warranty and purchase protection, providing added security for your purchases.

How to check Tim Hortons Credit Card balance?

Check your balance in the Tim Hortons app under the Tims Financial tab, which is managed entirely through the new division of Tim Hortons. You can also view transactions and rewards points there or contact customer service at 1-866-846-2273.

How to contact Tim Hortons Credit Card customer service for assistance with your cardholders earn benefits?

Call 1-866-846-2273 or use the Tim Hortons app to access support through the Tims Financial tab.

What are the credit score requirements for the Tim Hortons Credit Card?

The standard Tims Mastercard requires a good credit score (typically 660+), but exact requirements aren’t disclosed. The secured version needs no credit check (except in Quebec) and is ideal for low or no credit history, helping users build their credit history.

What is the Tims Credit Card phone number for Canadians who apply?

Reach customer service at 1-866-846-2273 for inquiries about your card, balance, or application regarding the Tims rewards card.

What are the requirements for the Tim Hortons Credit Card?

s credit card.

For the standard card: Good credit history and a credit check.

For the secured card: A deposit ($50–$10,000), no hard credit check (except Quebec).

No minimum income required for either.

The Bottom Line

The Tim Hortons Credit Card is a fantastic pick for Tims enthusiasts who want to earn free coffee and treats without paying an annual fee. Its standout 5 points per $1 at Tim Hortons is hard to beat for loyal customers, but the limited redemption options and low rewards on non-Tims purchases make it less appealing for occasional visitors or those seeking flexible rewards. Before you apply, assess your spending habits to ensure this card aligns with your lifestyle and financial tools to manage your everyday expenses.

Disclaimer:

Always verify the latest terms, rates, and rewards with the card issuer, as they are subject to change, especially in the context of the Tims rewards card. For more details, check Tangerine’s website.

share

0 Comments on “Tims credit card: Is the Tim Hortons Coffee card Available to Earn in 2025”