RBC Cash Back MasterCard 2025: pros and cons

The RBC Cash Back MasterCard stands out as a prime choice for individuals aiming to maximize their cash-back rewards on everyday purchases. RBC is a major Canadian bank, and their credit cards are popular. But are their no-fee cards actually good? This article will explore the RBC Cash Back MasterCard’s that offer rewards and compare them to other options.

Key Features of the RBC Cash Back MasterCard

Cash Back Rewards on Every Purchase

The RBC Cash Back MasterCard offers an enticing cash-back rate on all purchases, allowing cardholders to earn a percentage of their spending back as a statement credit. This feature is particularly beneficial for those who use their card for routine transactions, such as groceries, gas, and recurring bills.

No Annual Fee

One of the most appealing aspects of the RBC Cash Back MasterCard is its no annual fee policy. This makes it an accessible option for a wide range of consumers, from students to retirees, ensuring that cardholders can enjoy the benefits of cash-back rewards without worrying about an additional cost.

Added Perks and Benefits

- Insurance Coverage: Cardholders benefit from comprehensive insurance coverage, including purchase protection and an extended warranty, providing peace of mind on new purchases.

- Flexible Redemption: RBC offers flexible redemption options for cash-back rewards, allowing cardholders to apply their cash back to their credit card statement at any time during the year.

- RBC Rewards: Beyond cash back, cardholders can convert their rewards into RBC Rewards points, offering further flexibility and value in redeeming rewards for travel, merchandise, and more.

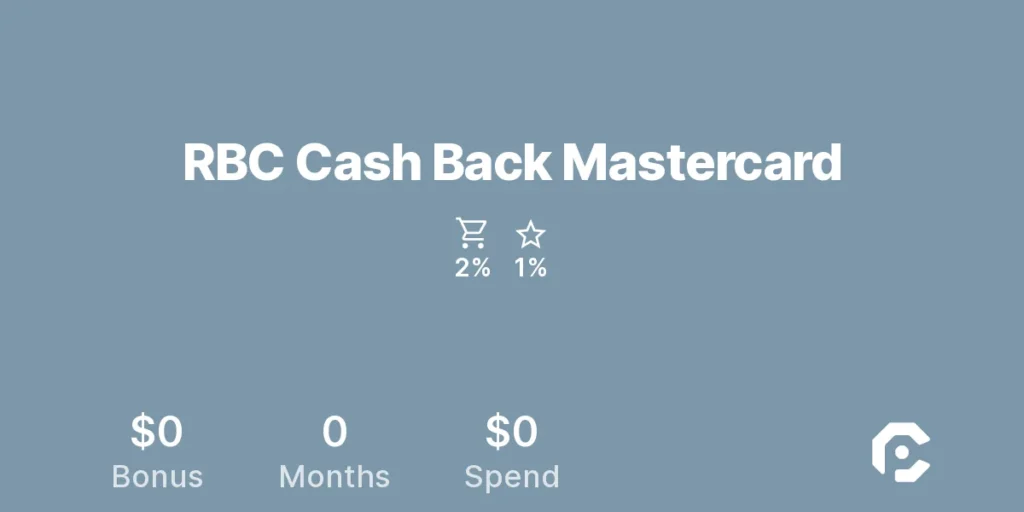

1. RBC Cash Back Mastercard

This card offers 2% cash back on groceries and 1% on everything else. While 2% on groceries sounds good, other cards offer more. For example, the Cashback Mastercard offers 3% on groceries. So, for a $100 grocery purchase, you’d get $3 back with the Cashback Mastercard and only $2 with RBC.

2. RBC Rewards Plus Visa

This card gives you 1 point for every dollar spent at grocery stores, gas stations, and drugstores, and 1 point for every $2 spent elsewhere. Each RBC point is worth about 2 cents for travel and 1 cent for other rewards. So, points are best redeemed for travel, giving you 2% back at grocery stores, gas stations, and drugstores and 1% back on everything else.

How These Cards Compare

- The Cashback Mastercard offers a higher cashback rate on groceries (3% vs. 2%).

- The Tangerine Money-Back Card lets you choose 2 categories for 2% cash back, including gas stations and drugstores.

- RBC Rewards Plus Visa points are more valuable for travel but less flexible for other redemptions.

Comparison to Competitors

When comparing the RBC Cash Back MasterCard to other cash-back credit cards on the market, it’s evident that its no annual fee and flexible redemption options set it apart. While some cards may offer higher cash-back rates in specific categories, the RBC Cash Back MasterCard provides a consistent cash-back rate on all purchases, making it a versatile option for everyday use.

RBC Cashback Mastercard: Pros and Cons

| Pros | Cons |

|---|---|

| Generous Cash Back Rewards | Cash-back rates might not be the Highest |

| No Annual Fee | Potential Fees for Late Payments, Cash Advances, and Balance Transfers |

| Competitive Benefits | Redemption Options Might Be Less Flexible Than Other Cards |

| Straightforward Reward Structure | |

| Easy to Track Earnings and Redeem Rewards | |

| Flexible Redemption Options (statement credit, deposit, future purchases) |

Conclusion

The RBC Cash Back MasterCard is an exemplary choice for consumers seeking to enhance their spending efficiency through cash-back rewards. With its no annual fee, comprehensive insurance coverage, and flexible redemption options, it offers a balanced package of benefits that cater to a wide array of financial needs and preferences.

By choosing the RBC Cash Back MasterCard, cardholders can enjoy the simplicity and value of earning rewards on their everyday transactions, making it a smart addition to anyone’s wallet.

Related FAQ’s

Is the RBC Cash Back Mastercard a good card for me?

This card is a great choice if you’re looking for a no-fuss cashback card to earn rewards on your everyday spending. It’s especially good if you value simplicity and flexibility in redeeming your cashback.

What kind of rewards do I get with this card?

The RBC Cash Back Mastercard offers a cashback program that lets you earn cash back on your everyday purchases.

How do I redeem my cashback rewards?

You have several flexible options for redeeming your cashback:

Apply it as a statement credit to reduce your balance.

Deposit it directly into your RBC savings account.

Use it towards future purchases.

Are there any fees associated with this card?

While the card itself has no annual fee, there might be potential fees for late payments, cash advances, or balance transfers. Be sure to review the fee schedule for details.

Is there anything else I should know about the card?

The RBC Cash Back Mastercard is known for its straightforward reward structure, making it easy to track your earnings and redeem your rewards. However, it’s important to compare cashback rates with other cards to see if it offers the best value for your spending habits.

0 Comments on “RBC Cash Back MasterCard 2025: pros and cons”