How I Protect Myself from Mail Theft: My Personal Tips and Experience

Mail theft is more than just an inconvenience—it’s a real threat to your personal and financial security. Over time, I’ve learned that taking a few simple precautions can make a big difference in keeping your sensitive information safe. Here’s what I do to protect myself from mail theft, and I hope these tips help you too.

What Is Mail Theft?

Mail theft happens when someone steals your mail either directly from your mailbox or while it’s on its way to you. Thieves often target items like credit cards, bank statements, and anything with personal information. They use this stolen data for identity theft, financial fraud, and other illegal activities.

Why Mail Theft Is Such a Big Deal

Having your mail stolen can have serious consequences. A stolen credit card can lead to unauthorized charges, and if someone gets their hands on your personal information, they could commit identity theft. This can take years to resolve and may involve unauthorized loans or even crimes committed in your name. That’s why I take mail security seriously.

How I Protect Myself from Mail Theft

- Invest in a Secure Mailbox I upgraded to a lockable mailbox that meets USPS security standards. It’s a small investment that goes a long way in keeping my mail safe from prying hands.

- Sign Up for Informed Delivery One of the best moves I made was signing up for USPS’s Informed Delivery. It’s a free service that lets me see what’s coming in the mail each day. If anything’s missing, I know right away and can take action.

- Pick Up Mail Quickly I make it a point to grab my mail as soon as possible after it’s delivered. When I’m out of town, I either ask a neighbor to collect it or use USPS’s mail hold service.

- Shred Sensitive Documents Before throwing away anything with personal info—like bank statements or credit card offers—I always shred it. This keeps would-be thieves from finding useful information in my trash.

- Go Paperless Switching to paperless billing has been a game-changer. I’ve minimized the amount of sensitive information that’s sent through the mail, reducing the risk of it falling into the wrong hands.

- Monitor My Accounts I regularly check my bank and credit card accounts for any unusual activity. I’ve also set up account alerts to notify me immediately if something suspicious pops up.

- Report Suspicious Activity Right Away If I ever suspect my mail has been tampered with or stolen, I don’t hesitate to report it to USPS and my local police. Quick action can make all the difference in preventing further issues.

Signs Your Mail Might Have Been Stolen

Keep an eye out for these red flags:

- Missing Mail: If you’re not receiving expected bills or statements, it might be a sign that someone’s taken your mail.

- Tampered Mailbox: A mailbox that looks like it’s been forced open is a major warning sign.

- Unexplained Financial Activity: Unauthorized charges or changes in your credit report could indicate your information was stolen through mail theft.

What to Do If Your Mail Gets Stolen

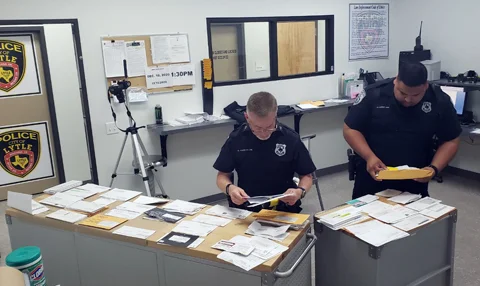

- Contact the USPS Report the theft to USPS immediately. They’ll investigate and involve law enforcement if needed.

- Notify Your Bank and Credit Card Companies Let your financial institutions know about the potential theft so they can watch for suspicious activity and take steps to protect your accounts.

- Place a Fraud Alert Consider putting a fraud alert on your credit report. This tells creditors to verify your identity before opening new accounts in your name.

- File a Police Report If your identity has been stolen, filing a police report is crucial. It helps when disputing fraudulent charges and may be required by credit bureaus.

- Monitor Your Credit Keep an eye on your credit report after any theft. Report any unauthorized activity to the credit bureaus immediately.

My Experience with Mail Theft

A few years ago, I had a close call with mail theft that really opened my eyes to how vulnerable we can be. I was expecting a new credit card to arrive in the mail, but it never showed up. At first, I thought it was just delayed, but then I noticed an unfamiliar charge on my bank statement. That’s when I realized my mail might have been stolen.

I immediately contacted my bank and the USPS. Thankfully, they were able to cancel the card before any more damage was done. After that experience, I took steps to secure my mailbox, switched to paperless billing, and signed up for Informed Delivery. These changes have given me peace of mind and made me much more aware of how important it is to protect my mail.

Final Thoughts

Protecting yourself from mail theft isn’t complicated, but it does require some vigilance. By securing your mailbox, going paperless, and staying on top of your financial accounts, you can significantly reduce the risk. I’ve found that these steps not only protect my mail but also give me peace of mind in our increasingly digital world.

Related FAQ’s

Q1: What is mail theft, and why should I be concerned?

A1: Mail theft occurs when someone steals mail from your mailbox or during transit. It’s a serious issue because thieves can use your stolen mail for identity theft, financial fraud, or other illegal activities. This can lead to unauthorized charges, new accounts opened in your name, and even crimes committed using your identity.

Q2: How can I protect my mail from being stolen?

A2: There are several steps you can take to protect your mail:

Use a lockable, secure mailbox.

Sign up for USPS Informed Delivery to monitor your mail.

Retrieve your mail promptly after delivery.

Shred documents with personal information before discarding them.

Switch to paperless billing to reduce sensitive mail.

Q3: What is USPS Informed Delivery, and how does it help?

A3: USPS Informed Delivery is a free service that lets you see a digital preview of your incoming mail before it arrives. This helps you keep track of what should be in your mailbox and allows you to take action if something goes missing.

Q4: What should I do if I suspect my mail has been stolen?

A4: If you suspect mail theft, follow these steps:

Report it to the USPS right away.

Contact your bank and credit card companies to alert them.

Consider placing a fraud alert on your credit report.

File a police report if your identity has been stolen.

Monitor your credit report for any suspicious activity.

Q5: How can shredding documents help prevent mail theft?

A5: Shredding documents that contain personal information, such as bank statements or credit card offers, ensures that thieves can’t find sensitive data in your trash. This simple step can prevent identity theft and financial fraud.

Q6: Is it really necessary to switch to paperless billing?

A6: Switching to paperless billing is a great way to reduce the amount of sensitive information that’s sent through the mail. While it’s not mandatory, it adds an extra layer of protection by keeping your financial details out of reach from potential thieves.

Q7: What are the signs that my mail might have been stolen?

A7: Some signs that your mail might have been stolen include:

Missing expected mail, like bills or bank statements.

A mailbox that appears tampered with or forced open.

Unexplained charges or activity on your financial accounts.

Q8: How often should I monitor my accounts for suspicious activity?

A8: It’s a good idea to regularly check your bank and credit card accounts, at least once a week. Set up account alerts to notify you of any unusual activity, so you can act quickly if something doesn’t look right.

Q9: Can I prevent mail theft if I’m going out of town?

A9: Yes! If you’re going to be away, ask a trusted neighbor to collect your mail or request a mail hold from USPS. This way, your mail won’t sit in your mailbox unattended for long periods, which reduces the risk of theft.

All images credit goes to google

share

Leave a Reply