FintechZoom.com: Find Best Student Credit Card for You in 2025

Lets find Best Student Credit Card for You in 2025 from FintechZoom.com. Discover the top student credit cards! Find the perfect card to build good credit. Hey students! Stepping into the world of personal finance, especially the world of credit, can feel like a lot. But guess what? Choosing the right student credit card is a fantastic first step toward building a solid financial future. Student credit cards are specifically designed for beginners like credit novices – think easier approvals, manageable credit limits, and perks tailored for you.

This guide will walk you through the best student credit cards for 2025, helping you find the perfect card to kickstart your financial journey. We’ll cover the benefits, what makes a card a good choice, top picks, and how to use your new card wisely.

What Makes Fintechzoom.com student Credit Card the Best Choice in 2025?

Before diving into student-specific cards, what generally makes any credit card the best choice? It boils down to how well it fits your life. The “best” isn’t one-size-fits-all. Consider these factors:

- Alignment with Your Spending: Does the card reward you for where you spend most often (groceries, dining, gas, travel)? Evaluate your spending habits carefully.

- Your Financial Goals: Are you aiming to earn simple cash back, maximize travel points, tackle debt with a 0% APR offer, or simply build credit history?

- Value Proposition: Do the rewards and benefits (like lounge access, insurance, statement credits) outweigh any annual fees?

- Your Credit Score: Premium rewards credit cards often require good credit or excellent credit, while cards designed for credit building (like many student credit cards) are more accessible.

- Understandable Terms: Clear terms regarding interest rates (APR), fees, and reward redemption make a card easier and safer to use.

Essentially, the right card enhances your finances without causing stress or debt.

Why Bother with a Student Credit Card?

Now, let’s focus on students. Think of a student credit card as more than just plastic – it’s your training wheels for the financial world and a key tool to build credit history. Here’s why getting one is a smart move:

- Build Your Credit Score: Using a credit card responsibly is one of the best ways to establish good credit. A positive credit history is essential for future goals like renting an apartment, getting car loans, or even passing some job background checks. These cards give you the opportunity to build credit from scratch.

- Learn Money Management: It’s a practical way to learn budgeting, track spending, and understand interest. Many cards offer credit monitoring tools.

- Earn Rewards: Why not get something back for buying textbooks or grabbing pizza? Many student credit cards offer rewards like cash back or points (rewards credit) on everyday purchases. Some cards offer rewards specifically appealing to students.

- Designed for Students: They often have low or no annual fees and more lenient approval requirements, making them accessible even if you’re new to credit. Many student credit cards are specifically designed for this purpose.

Top Picks: The Best Student Credit Cards for 2025

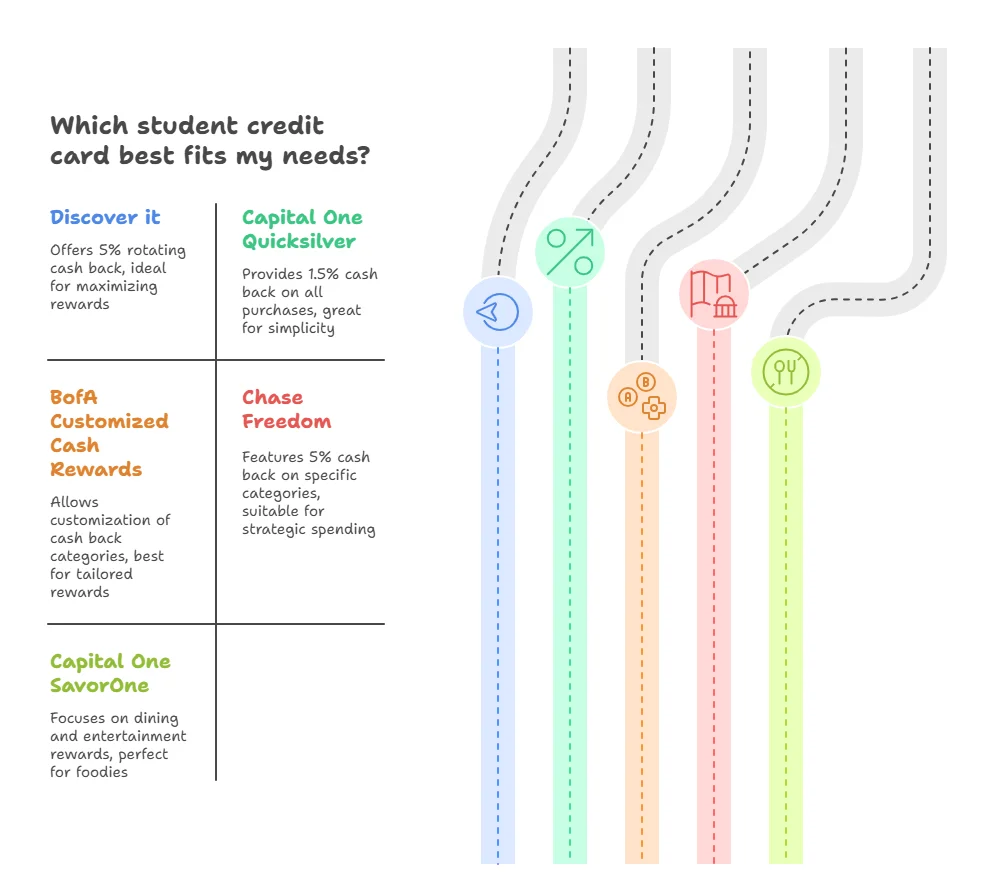

Based on rewards, accessibility, and student-friendly features, here are some top picks for 2025, building on trends seen in credit cards for May 2024 and the rest of 2024:

1. Discover it® Student Cash Back

- Best For: Maximizing cash back in rotating categories.

- Key Features: 5% cash back on rotating categories each quarter (like gas, groceries, restaurants, up to a cap, activation required), 1% on everything else. Unlimited Cashback Match™ – Discover doubles all cash back earned in your first year. $0 annual fee. Free FICO® credit score access.

- Why It’s a Top Contender: The Cashback Match makes the first year incredibly valuable. This Discover it® student cash back card is known for being forgiving for those with no credit history. It’s among the best for learning about bonus categories.

- Good to Know: You need to remember to activate the 5% categories quarterly.

2. Capital One Quicksilver Student Cash Rewards Credit Card

- Best For: Simple, flat-rate cash back rewards.

- Key Features: Unlimited 1.5% cash rewards credit card on every purchase. No rotating categories to track. $0 annual fee. Potential to earn a small welcome bonus. Access to CreditWise for credit monitoring.

- Why It’s a Top Contender: Simplicity is key. If you don’t want to track categories, this student cash rewards credit card offers solid, consistent rewards on everything. It’s a straightforward way to build credit responsibly.

- Good to Know: The flat 1.5% is good, but you might earn more elsewhere if your spending is concentrated in specific bonus categories.

3. Bank of America® Customized Cash Rewards Credit Card for Students

- Best For: Customizable rewards tailored to your spending.

- Key Features: 3% cash back in a category you choose each month (from options like gas, online shopping, dining, travel, drug stores, or home improvement/furnishings). 2% cash back at grocery stores and wholesale clubs. 1% on all other purchases (3% & 2% categories apply to the first $2,500 in combined spending per quarter). $0 annual fee. Potential for a cash rewards welcome bonus.

- Why It’s a Top Contender: Flexibility! This Bank of America® cash rewards credit card lets you align your top bonus category with where you spend most. It’s ideal for students whose spending changes.

- Good to Know: You need to remember to select your 3% category each month (or let it default) and be mindful of the quarterly spending cap on bonus categories.

4. Chase Freedom® Student Credit Card

- Best For: Building a relationship with Chase and earning rewards for good habits.

- Key Features: 1% cash back on all purchases. $50 bonus after your first purchase within three months. Get a credit limit increase after making 5 on-time monthly payments within 10 months. $20 Good Standing Reward each account anniversary for up to 5 years. $0 annual fee.

- Why It’s a Top Contender: While the rewards rate is basic, Chase incentivizes responsible credit card use with the Good Standing Reward and potential credit line increase. Starting with Chase can be beneficial for accessing their premium travel credit cards later. This card is perfect for students prioritizing credit building.

- Good to Know: The 1% cash back is lower than some competitors.

5. Capital One SavorOne Student Cash Rewards Credit Card

- Best For: Students who spend on dining, entertainment, groceries, and streaming.

- Key Features: Unlimited 3% cash back on dining, entertainment, popular streaming services, and at grocery stores (excluding superstores like Walmart® and Target®). 1% on other purchases. 10% cash back on Uber & Uber Eats (through 11/14/2024 – check for current offers for 2025). $0 annual fee.

- Why It’s a Top Contender: This Capital One® SavorOne Student Cash Rewards card is a powerhouse for social butterflies and foodies. The SavorOne Student Cash Rewards credit card (one® savorone student cash rewards) offers high returns on common student spending areas without an annual fee. Makes this card an excellent option.

- Good to Know: Ensure your favorite grocery store isn’t excluded from the bonus category.

Are Cashback Credit Cards Better Than Travel Credit Cards?

You’ll see many student credit cards focusing on cash back. But are cash back cards inherently “better” than travel credit cards? It depends entirely on your priorities:

- Cash Back Cards:

- Pros: Simple, straightforward rewards (e.g., 1.5% back on everything or bonus categories like dining/groceries). Easy to understand and redeem (often as a statement credit or direct deposit). Usually have low or no annual fee. Great for everyday purchases.

- Cons: Reward value is fixed (1% is always 1 cent per dollar). Don’t usually offer premium travel perks like lounge access or free checked bags.

- Travel Credit Cards:

- Pros: Can offer high potential value when points/miles are redeemed strategically for flights or hotels. Often come with valuable travel perks (lounge access, insurance, TSA PreCheck credits, no foreign transaction fees).

- Cons: Rewards programs can be complex. Point values can vary depending on redemption. Often have higher annual fees. Perks are only valuable if you travel frequently. May require good credit to qualify.

For most students, especially those new to credit, a cash back card is often the best choice. Its simplicity and direct value on everyday spending are highly practical. However, if you already travel frequently, a student-friendly travel card could be considered.

Finding the Perfect Card: Key Features to Consider

When you look for a card, especially a student one, keep these features in mind:

- Low or No Annual Fee: This is crucial for students on a budget. Luckily, most student credit cards have no annual fee.

- Achievable Rewards: Look for a rewards credit card for students that matches your spending habits. Whether it’s a flat-rate cash rewards credit card or one with bonus categories, ensure you can realistically earn and benefit from the rewards. Gift cards can also be a redemption option.

- Credit-Building Tools: Free access to your credit score or tools to track your credit report progress are valuable perks. Credit building features are key.

- Intro Offers: Some cards offer a 0% intro APR (interest rate) for a limited time, which can be helpful, but focus on paying your balance off regardless.

- Reasonable Credit Line: Student credit cards often start with lower credit limits, which helps prevent overspending as you learn.

How to Choose the Right Student Credit Card for You

Okay, lots of best options! How do you choose a card?

- Analyze Your Spending Habits: Where does your money go? Pick a card that aligns with your lifestyle. If you eat out a lot, the SavorOne Student might be great. If you prefer simplicity, the Quicksilver Student is a solid bet. Choosing the right student credit card starts here.

- Compare Rewards vs. Effort: Are you willing to track categories (Discover it®) or change your choice category (Bank of America®) for potentially higher rewards? Or do you prefer a set-it-and-forget-it rewards card (Quicksilver Student)?

- Check Fees: Stick to $0 annual fee cards. If you plan to study abroad or travel, look for no foreign transaction fees. Understanding potential costs is key to finding the best fit.

- Focus on Building Credit: Remember, the primary goal for students looking to build their credit is just that – building credit. Features like free credit score access are valuable. This is especially true for students looking to build their credit while earning some rewards.

- Future Goals: Consider if starting with a specific bank might offer upgrade paths to better cards later on.

What Are the Common Fees Associated with Credit Cards?

While many student credit cards come with fewer fees, it’s crucial to understand common charges you might encounter with any credit card:

- Annual Fee: A yearly charge just for having the card. Most student cards waive this, but many premium rewards credit cards have them.

- Late Payment Fee: Charged if you don’t pay at least the minimum amount due by the deadline. This also hurts your credit score. Avoid this at all costs!

- Foreign Transaction Fee: A percentage (often ~3%) charged on purchases made outside your home country or in a foreign currency online. Look for cards with no foreign transaction fees if you travel or shop internationally.

- Balance Transfer Fee: Charged when you move debt from one card to another, usually a percentage (3%-5%) of the transferred amount. Even 0% APR offers often have this fee.

- Cash Advance Fee: Charged if you use your credit card to withdraw cash from an ATM. Interest often starts accruing immediately on cash advances, making them very expensive. Avoid this.

- Over-Limit Fee: Charged if you spend beyond your credit limit. Less common now due to regulations, but still possible if you opt-in.

Being aware of these potential fees helps you use your card responsibly. Many cards, especially student ones, are designed to minimize these, but always read the terms.

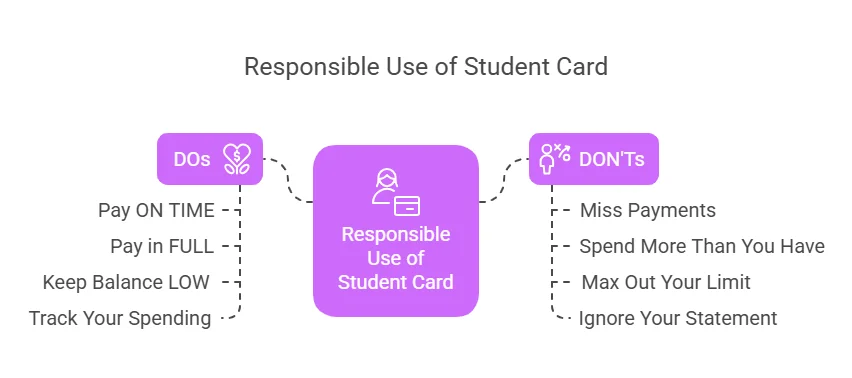

Using Your Student Credit Card Responsibly: The Golden Rules

Getting the card is step one; using it wisely is crucial. Responsible credit card use is the name of the game:

- Pay On Time, Every Time: Late payments hurt your credit score and trigger fees. Set up auto-pay for the minimum payment (but aim to pay more!) or calendar reminders.

- Pay in Full if Possible: Avoid carrying a balance month-to-month. Interest rates on student credit cards can be high, and paying interest negates your rewards. Treat it like a debit card – only spend what you can afford to pay off.

- Keep Balances Low: Aim to use less than 30% of your credit limit. This is called credit utilization, and keeping it low helps your credit score.

- Track Your Spending: Use the bank’s app or website to monitor your purchases and stay within budget. Understand your statement credit and due dates. A card for everyday purchases requires tracking.

- Read the Fine Print: Understand the APR, fees, grace periods, and how rewards work (cards offer rewards, but know the rules!).

Final Thoughts: Your First Step to Financial Success

Choosing the right credit card from the many student credit cards available is a significant step. Whether the Discover it® Student Cash Back card‘s rotating rewards appeal to you, or the Capital One Quicksilver Student Cash Back card stands out for simplicity, the best student credit card is the card that fits your needs and helps you practice responsible credit card use.

These credit cards provide a fantastic opportunity to build credit and learn valuable financial habits. Start small, pay diligently, and use the tools these cards offer. You’re not just getting a card; you’re building the foundation for a solid credit history and a brighter financial future. This card is a compelling option to start. Ready to discover the top options? Compare these beneficial student credit cards and select a card to begin your journey today!

FAQ,s Related to FintechZoom.com Best Student Credit Cards

What is the best credit card for a student?

There’s no single “best” card – it depends on you! Look for one that matches your spending (like cash back on food or gas) and has low fees. Cards like the Discover it® Student Cash Back (good for rotating rewards) or Capital One Quicksilver Student (simple flat-rate cash back) are popular starting points. The best one helps you build credit safely.

What bank has the best credit card for students?

No single bank is universally “best.” Banks like Discover, Capital One, Bank of America, and Chase all offer strong student credit cards. Compare their specific card features (rewards, fees, tools) to see which aligns best with your needs.

Are premium credit cards worth the annual fee?

Sometimes, but usually not for students starting out. They’re worth it only if the value of the perks you actually use (like travel credits, lounge access, high rewards) is more than the annual fee. If you won’t use the perks enough, a no-annual-fee card is smarter.

Can you switch credit cards without affecting your credit score?

It’s tricky. Applying for a new card creates a small, temporary dip (hard inquiry). Closing an old card can hurt your score by reducing your average account age and available credit. A “product change” (upgrading/downgrading within the same bank) often has less impact as it keeps the account history open. Avoid frequently opening/closing cards.

How Do Different Types of Credit Cards Work?

Rewards Cards: Give points, miles, or cash back on spending.

Balance Transfer Cards: Offer a 0% intro APR period to pay off debt moved from another card.

Student Cards: Help students build credit, often with easier approval.

Secured Cards: Require a cash deposit as collateral, good for building/rebuilding credit.

Travel Cards: Offer travel points/miles and perks like lounge access.

Business Cards: For business expenses, with business-focused rewards.

How do business credit cards differ from personal credit cards?

Business cards are for company expenses, often have higher credit limits, offer business-related rewards, and usually don’t affect your personal credit utilization (but may still require a personal guarantee). Personal cards are for individual spending and directly impact your personal credit report and score.

How does a 0% interest credit card work?

It offers an introductory period (e.g., 12-21 months) where you pay 0% interest on new purchases or balance transfers. It’s a great tool to pay off large items or debt interest-free if you pay off the balance before the intro period ends. After that, the standard (usually high) interest rate applies to any remaining balance.

What are the benefits of student credit cards?

They’re designed to help you:

Start building a credit history.

Learn responsible spending and payment habits.

Earn rewards on your purchases.

Get approved more easily with limited/no credit.

Avoid annual fees (most student cards have none).

What makes student credit cards different from regular credit cards?

The main differences are:

Easier Approval: Designed for those new to credit.

Lower Credit Limits: Often start with smaller credit lines to minimize risk.

Focus on Education: May offer tools or tips for credit building. Regular cards usually require a more established credit history and income, offering potentially higher limits and rewards.

Why Use FintechZoom.com for Credit Card Search?

Financial comparison websites like FintechZoom can be useful starting points. They often gather information on many credit cards, allowing you to compare features, rewards, and fees in one place. However, offers change quickly, so always double-check the details and apply directly on the bank’s official website to ensure accuracy.

Disclaimer

The information provided in this article is for general informational purposes only and does not constitute financial advice. Credit card offers, terms, rewards, fees, and conditions are subject to change at the discretion of card issuers. Always verify the most current details, including annual fees, interest rates, introductory offers, and eligibility requirements, directly with the credit card issuer’s official website before applying. Your financial situation and creditworthiness may affect your ability to qualify for certain cards. We are not responsible for any decisions made based on this information or for any errors or omissions in the content.

share

0 Comments on “FintechZoom.com: Find Best Student Credit Card for You in 2025”