Explore Yezzit.com Credit Cards: Everything You Need to Know!

today we Discover everything about yezzit.com credit cards! Learn about the application process, cashback rewards, and the benefits to help you build credit effectively with Yezzit.com credit cards. Navigating the world of credit cards can be overwhelming, but Yezzit.com aims to make it easier with their unique lineup of cards. Whether you’re looking for low interest rates, cash back, or travel rewards, Yezzit.com offers a variety of options that cater to different financial needs. In this guide, we’ll break down everything you need to know about Yezzit.com credit cards, including eligibility requirements and customer reviews for Yezzit.com credit, helping you make an informed decision.

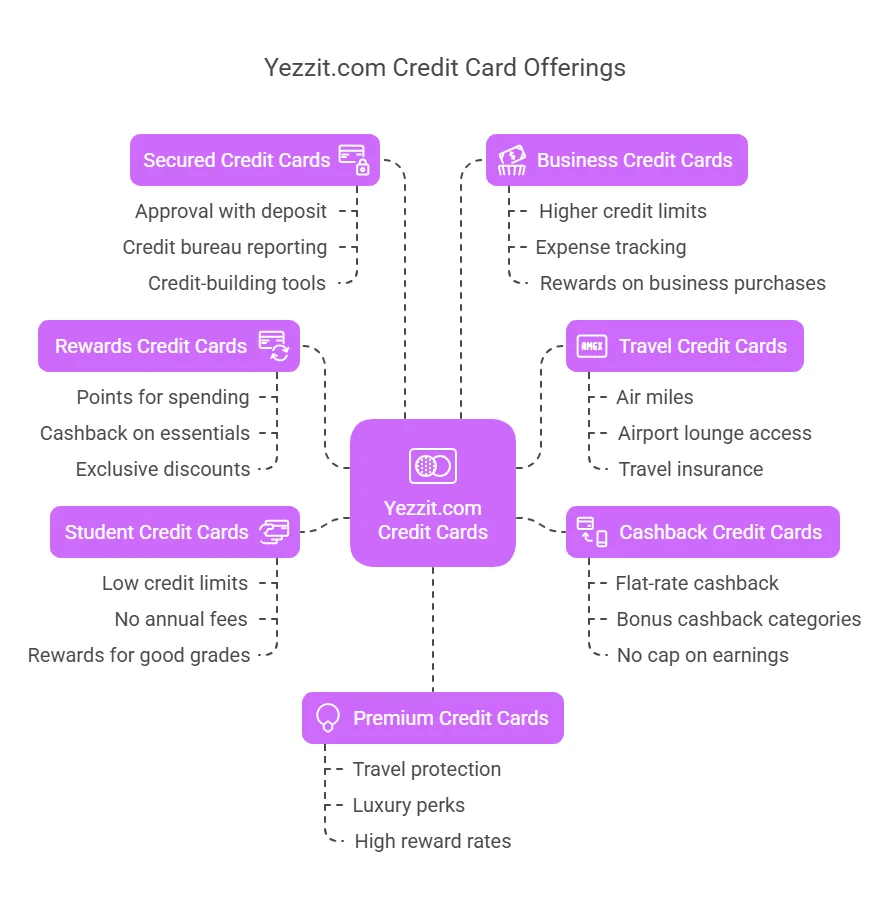

Types of Credit Cards Offered by Yezzit.com

In today’s fast-paced world, credit cards have become an essential financial tool, especially those that offer travel benefits. Yezzit.com, a trusted name in the financial industry, offers a diverse range of credit cards tailored to meet the unique needs of its customers, including options to explore Yezzit.com credit cards with better rewards. Whether you’re a frequent traveler, a savvy shopper, or someone looking to build or rebuild your credit, Yezzit.com has the perfect card for you. Here’s an overview of the types of credit cards available.

1. Rewards Credit Cards

Yezzit.com rewards credit cards are designed for individuals who want to earn points, cashback, or other benefits on their everyday spending. These cards typically offer:

- Points for every dollar spent.

- Cashback on groceries, dining, and fuel.

- Exclusive discounts with partner merchants.

2. Travel Credit Cards

For the globetrotters, Yezzit.com’s travel credit cards provide exceptional benefits, including:

- Air miles for every purchase.

- Complimentary airport lounge access.

- Travel insurance and zero foreign transaction fees.

3. Cashback Credit Cards

Maximize your savings with Yezzit.com’s cashback credit cards. These cards offer:

- Flat-rate cashback on all purchases encourages better spending habits.

- With Yezzit.com, you can earn bonus cashback on specific categories like dining or online shopping, maximizing your rewards.

- No cap on cashback earnings.

4. Choosing the right credit card can significantly impact your financial journey. Student Credit Cards

Yezzit.com understands the importance of building credit early. Their student credit cards feature:

- Low credit limits to encourage responsible spending.

- No annual fees.

- Rewards for good grades or responsible usage can motivate young adults to choose the right credit card.

5. Secured Credit Cards

Perfect for individuals looking to build or rebuild their credit, secured credit cards from Yezzit.com offer:

- Approval with a refundable security deposit.

- Reporting to major credit bureaus to help improve your scoress.

- Access to credit-building tools and resources.

6. Business Credit Cards

Entrepreneurs and business owners can benefit from Yezzit.com’s business credit cards, which include:

- Higher credit limits for business expenses.

- Expense tracking and management tools.

- Rewards on business-related purchases like office supplies and travel.

7. Premium Credit Cards

For those who want the best of the best, Yezzit.com’s premium credit cards offer:

Comprehensive travel and purchase protection.redit cards a compelling option for consumers who want value, flexibility, and the ability to customize their rewards.

Luxury perks such as concierge services and exclusive event access.

Higher reward rates on premium spending categories.

Key Features of Yezzit.com Credit Cards

Understanding the core features of Yezzit.com credit cards can help you see why they stand out from the competition:

- Low Interest Rates: Ideal for those who occasionally carry a balance, these cards help minimize interest charges, reducing the overall cost of borrowing and keeping your credit utilization low.

- Flexible Credit Limits: Whether you’re a student, a professional, or a frequent traveler, Yezzit.com provides varying credit limits that match different financial profiles.

- Robust Reward Programs:

- Cashback on Everyday Purchases can help you build your credit over time.: You can earn cashback on groceries, gas, dining, and more, putting money back in your pocket with every purchase.

- Travel Rewards: Accumulate travel miles with each transaction, which can be redeemed for flights, hotel stays, and even car rentals.

- Shopping Discounts: Get exclusive discounts with partnered retailers, making every purchase feel like a deal while enhancing your spending habits.

- No Annual Fees: Some Yezzit.com cards waive the annual fee, giving you the convenience of a credit card without the recurring costs.

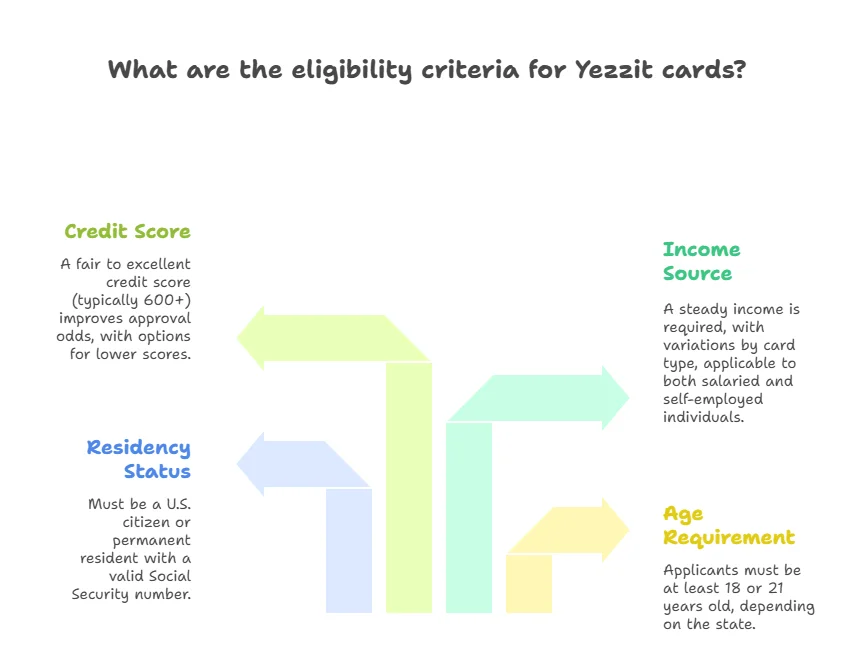

Yezzit Credit Card Eligibility Criteria

Wondering if you qualify for a Yezzit credit card? The eligibility requirements are straightforward and designed to accommodate a range of applicants. Here’s what you need to know:

- Age: You must be at least 18 years old (or 21 in some states) to apply.

- Residency: Applicants need to be U.S. citizens or permanent residents with a valid Social Security number.

- Income: A steady source of income is required, though the minimum varies by card type. Yezzit considers both salaried and self-employed individuals.

- Credit Score: While Yezzit offers cards for different credit profiles, a fair to excellent score (typically 600+) boosts your approval odds. Some cards cater to those with lower scores, making it a versatile option.

Documents Required for the Yezzit Credit Card Application Process

Applying for a Yezzit credit card is simple, and most of the process can be completed online. While you won’t always need to submit physical documents, having certain information ready speeds things up. Here’s what’s typically required:

- Proof of IdentityA government-issued ID like a driver’s license or passport is required documentation when you apply for Yezzit.com credit.

- Proof of Income: Recent pay stubs, W-2 forms, or tax returns to verify your earnings.

- Proof of Address: A utility bill or bank statement showing your current residence.

- Social Security Number: Needed for credit checks and verification. If it can’t be electronically confirmed, you may need to provide a copy of your SSN card.

How to Apply for Yezzit.com Credit Cards

Applying for a Yezzit.com credit card is a straightforward process, designed to be user-friendly:

- Online Application: Start by filling out the online application form on Yezzit.com. This form will ask for basic personal information, such as your name, address, and financial details.

- Credit Check: Yezzit.com performs a soft credit inquiry, meaning it won’t affect your score. This helps them assess your eligibility.

- Approval & Activation: Once approved, you will receive your new credit card by mail. Simply follow the activation instructions, and you’re ready to start using your card.

Yezzit.com also provides a pre-qualification tool so you can estimate your approval chances before submitting a formal application. This is a great way to explore your options without risking a hard credit check.

Benefits of Using Yezzit.com Credit Cards

There are many perks to choosing a Yezzit.com credit card, and here are some of the most notable:

1. Financial Flexibility

Yezzit.com offers options to match your financial lifestyle, whether you’re aiming to earn rewards, minimize fees, or access a lower interest rate, all of which are highlighted in customer reviews for Yezzit.com credit cards. Their diverse card offerings make it easy to find one that fits your budget and goals, especially if you want to build credit and maximize your financial potential.

2. Enhanced Security

Security is a top priority, and Yezzit.com credit cards come equipped with EMV chip technology, which ensures safe transactions. In addition, the platform provides Fraud protection is essential when using your unsecured credit card options wisely to help you build credit., alerting you immediately if any suspicious activity occurs.

3. Mobile App Convenience

Manage your account on the go with Yezzit.com dedicated mobile app. Track your spending, make payments, set limits, and monitor transactions in real time. The app offers a streamlined experience, ensuring you always have control of your expanse’s.

Tips for Managing Your Yezzit.com Credit Card

Managing a credit card responsibly is key to building a strong financial future. Here are some tips to get the most out of your Yezzit.com credit card:

- Track Your Spending: Regularly check your transactions through the Yezzit.com app to ensure you’re staying within budget.

- Pay Off Your Balance in Full each month to help you build credit and avoid interest charges.: Avoid interest charges by paying your balance in full each month. This also helps maintain a good score.

- Maximize Rewards: Use your card strategically for purchases that qualify for cashback or rewards to maximize your benefits.

By following these practices, you can use your Yezzit.com credit card to its fullest potential while building your credit and improving your financial health through the Yezzit.com mobile app.

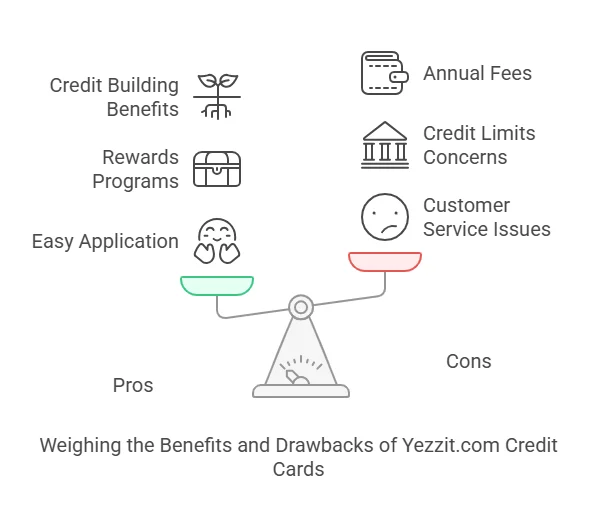

outlining the pros and cons of Yezzit.com credit cards

| Pros | Cons can arise if you do not choose the right credit card for your financial goals. |

|---|---|

| Low Interest Rates: Helps users manage credit responsibly. | Strict Eligibility Criteria: May be difficult for those with lower credit building. |

| No Annual Fees: Some cards offer no annual fees, reducing overall cost. | Variable Interest Rates can affect your ability to keep your credit utilization low.: Interest rates may vary depending on creditworthiness. |

| Flexible Credit Limits: Suited for individuals with different income levels. | Limited Availability: Certain card options may not be available in all regions. |

| Robust Reward Programs: Cashback, travel miles, and exclusive discounts. | High Fees for International Transactions can diminish the travel benefits of some credit cards.: May incur higher fees for overseas use. |

| Enhanced Security Features to protect your credit profile.: EMV chip technology and fraud protection. | Limited Card Options: Fewer options compared to bigger banks, limiting your access to exclusive offers. |

| User-Friendly Mobile App: Real-time transaction tracking and spending control. | May Not Offer Premium Benefits: Lacks some luxury perks like airport lounge access. |

Potential Drawbacks to Consider

While Yezzit.com credit cards offer plenty of perks, there are some considerations to keep in mind:

- Eligibility Requirements: Some cards may have higher score requirements, making it difficult for individuals with lower scores to qualify.

- Variable Interest Rates: While Yezzit.com advertises competitive interest rates, these can vary based on your creditworthiness. This means you could end up with a higher rate than expected.

Weighing these pros and cons will help you make a more informed decision when choosing a credit card that suits your financial needs.

Conclusion: Is a Yezzit.com Credit Card Right for You?

Yezzit.com credit cards are packed with features designed to enhance your financial flexibility. Whether you’re looking for low interest rates, valuable rewards, or enhanced security, these cards deliver on all fronts. With their user-friendly application process, no annual fees on some cards, and a range of customizable rewards, they are a great option for consumers looking to get the most out of their credit.

That said, it’s important to assess your individual financial situation before applying to ensure you qualify for the best terms possible.

If you’re in search of a credit card that offers value, convenience, and flexibility, Yezzit.com credit cards might just be the perfect fit.

FAQs based on the Yezzit.com credit card

1. What types of credit cards does Yezzit.com offer?

Yezzit.com offers a variety of credit cards tailored to different needs, including cards with cashback rewards, travel perks, low-interest rates, and no annual fees. Whether you’re focused on everyday savings or earning rewards, there’s likely a card for you.

2. How do I apply for a Yezzit.com credit card?

Applying for a Yezzit.com credit card is easy! Simply visit their website, fill out the online application form with your personal and financial details, and wait for a quick credit check. You can even use their pre-qualification tool to see if you’re eligible without affecting your credit score.

3. Do Yezzit.com credit cards have annual fees?

Some Yezzit.com credit cards come with no annual fees, making them a great option if you’re looking to avoid extra costs. Be sure to check the details for the specific card you’re interested in.

4. What rewards can I earn with a Yezzit.com credit card?

Depending on the card, you can earn rewards like cashback on everyday purchases (groceries, dining, fuel), travel miles for flights and hotels, and even exclusive discounts from partner retailers.

5. Is it safe to use a Yezzit.com credit card?

Yes! Yezzit.com credit cards come with enhanced security features, including EMV chip technology and fraud protection. They also alert you to any suspicious activity, giving you peace of mind while shopping.

6. What is the interest rate on Yezzit.com credit cards?

Yezzit.com offers low-interest rates on many of its cards. However, rates can vary based on your creditworthiness, so it’s a good idea to check the terms before applying.

7. Can I manage my Yezzit.com credit card with a mobile app?

Absolutely! Yezzit.com provides a user-friendly mobile app where you can track your spending, pay bills, and even set spending limits for better control over your finances.

8. Are there any drawbacks to using Yezzit.com credit cards?

While Yezzit.com credit cards offer great features, some cards may have strict eligibility criteria or variable interest rates depending on your credit score. Also, there could be higher fees for international transactions or fewer premium benefits compared to other cards.

9. What credit score do I need to qualify for a Yezzit.com credit card?

Eligibility varies by card, but generally, you’ll need a good credit score to qualify for the best offers. However, Yezzit.com provides a pre-qualification tool that lets you check your chances without impacting your credit score.

10. How can I maximize the benefits of my Yezzit.com credit card?

To make the most of your card, use it for purchases that earn rewards, like groceries or travel. Pay off your balance in full each month to avoid interest charges, and track your spending through the mobile app to stay on top of your finances.

Are there any specific eligibility requirements for Yezzit.com credit cards?

Yes, to qualify for a Yezzit.com credit card, you need to meet a few basic requirements that ensure you get the right card for your financial situation. These include being at least 18 years old, having a steady source of income, and maintaining a good credit score. Specific eligibility criteria may vary depending on the type of card you apply for, so be sure to check the details for your chosen card.

Can I use the Yezzit.com Credit Card internationally?

Absolutely! Yezzit.com credit cards are accepted worldwide wherever the card’s payment network (e.g., Visa, Mastercard) is supported. Just ensure you inform your bank of your travel plans to avoid any transaction issues and check for any applicable foreign transaction fees.

How can improve credit score with the right card to build or rebuild your credit?

Improve their credit score is simple if you follow these steps:

Always pay your credit card bills on time.

Keep your credit utilization ratio below 30%.

Avoid applying for multiple credit cards or loans in a short period.

Regularly check your credit report for errors and dispute any inaccuracies.

Maintain long-term credit accounts to build a positive credit history.

Is there a grace period for payments on Yezzit.com credit cards?

Yes, it offer a grace period, typically ranging from 20 to 25 days, for you to pay your outstanding balance without incurring interest, which can help you build credit. To take full advantage of this, pay your balance in full before the due date.

What security features that credit cards offer?

Yezzit.com credit cards come with robust security features, including:

EMV chip technology for secure transactions.

Fraud detection systems to monitor suspicious activity.

Zero liability protection for unauthorized transactions.

Two-factor authentication for online purchases.

24/7 customer support to address security concerns promptly.

What should I do if I encounter issues with my Yezzit.com credit card options?

If you face any issues with your Yezzit.com credit card account, here’s what you can do:

Contact Yezzit.com customer service immediately.

Report lost or stolen cards to prevent unauthorized use.

For billing errors or disputes, provide supporting documents to resolve the issue quickly.

Use the Yezzit.com mobile app to track transactions and manage your credit card account.

Disclaimer

The information provided in this article about Yezzit credit cards, including eligibility criteria, required documents, and consumer reviews, is based on general knowledge and publicly available data now. This content is intended for informational purposes only and does not constitute financial advice. Credit card terms, conditions, and availability may vary, and approval is subject to Yezzit’s discretion and underwriting standards. Consumer reviews reflect individual experiences and may not represent all users’ outcomes. Always visit Yezzit.com or contact their customer service for the most current and accurate details before applying. The author and publisher are not affiliated with Yezzit and are not responsible for any decisions made based on this article.

share

0 Comments on “Explore Yezzit.com Credit Cards: Everything You Need to Know!”