Traceloans.com Mortgage Loans: Unlock Home Financing & Savings

Traceloans.com mortgage loans: Unlock home financing & savings! Explore mortgage options and loan options for homebuyers. Find the perfect fit today! Buying a home is one of life’s biggest milestones, but navigating the mortgage process can feel overwhelming.

That’s where Traceloans.com mortgage loans come in—offering borrowers a smarter, easier, and more affordable way to secure the right mortgage. In 2025, platforms like Traceloans.com are leading the mortgage industry with transparent terms, competitive interest rates, and an online platform designed to simplify everything from comparing rates to refinancing an existing mortgage.

Why Choose Traceloans.com? 7 Features That Stand Out

The features of Traceloans.com make it a game-changer for today’s homebuyers. Here’s why many borrowers prefer this lender over traditional banks.

1. Competitive Rates That Unlock Exceptional Savings

With mortgage interest rates trending lower in 2025, Traceloans.com mortgage loans provide a streamlined path to savings. Even a small difference in rate can save thousands over the life of the loan.

2. No Hidden Fees

Transparency is key. Unlike some traditional mortgage lenders that surprise you with extra costs, Traceloans.com guarantees clear terms with no hidden fees.

3. A Simple Mortgage Application Process

The mortgage application process at Traceloans.com is fast, intuitive, and digital-first. Borrowers can apply online, upload documents, and track progress in real time.

4. Flexible Loan Options

From conventional loans to FHA loans, VA loans, and even jumbo loans, Traceloans.com mortgage loans offer a variety of mortgage options tailored to your financial situation.

5. Approval That Works for Many Borrowers

With flexible credit score requirements, Traceloans.com helps borrowers who may have been turned away by other lenders.

6. Customer-First Mortgage Experience

Dedicated mortgage advisors help borrowers make informed decisions, whether buying their first home or looking to refinance.

7. User-Friendly Online Platform

The online platform designed by Traceloans.com lets you manage payments, track your current mortgage, and compare loan terms with ease.

Types of Mortgage Loans Offered by Traceloans.com

The mortgage marketplace offers various mortgage products tailored to different needs.

- Fixed-Rate Mortgage – Predictable monthly payments for the entire loan term.

- Adjustable-Rate Mortgage (ARM) – Lower starting rates that adjust with market conditions.

- FHA Loans – Low down payment options for first-time homebuyers.

- VA Loans – Exclusive benefits for veterans and active-duty service members seeking homeownership.

- Jumbo Loans – Financing for high-value properties.

These loan options are designed to help borrowers choose the right mortgage for their financial situation and long-term goals.

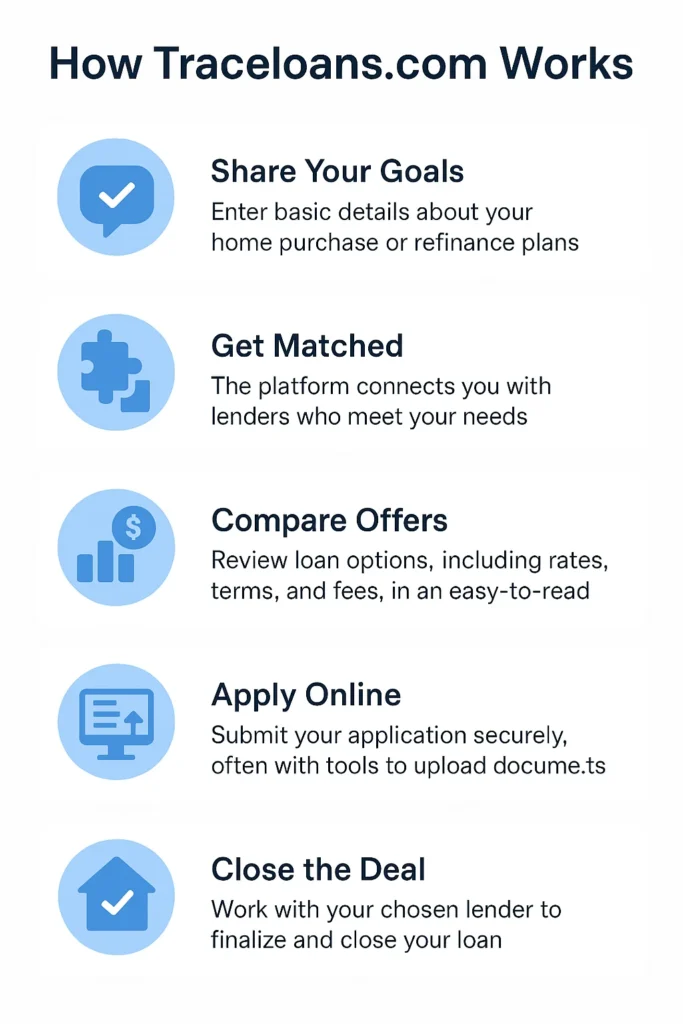

How the Mortgage Process Works on Traceloans.com

Traceloans.com simplifies the process into five easy steps.

- Pre-Qualification – Borrowers enter basic details to explore their buying power without affecting their credit score, based on market conditions.

- Compare Offers – The platform connects borrowers with multiple lenders, showing competitive interest rates and terms side by side.

- Apply Online – Complete the mortgage application process securely with document uploads.

- Approval & Underwriting – Flexible policies mean more approvals, even for unique financial situations.

- Close the Deal – Transparent closing costs and optional e-signatures for convenience.

What Are the Common Mortgage Loan Mistakes to Avoid?

Even with a trusted platform like Traceloans.com, borrowers should avoid these common mistakes:

- Ignoring credit score improvement before applying.

- Overlooking hidden costs like property taxes and insurance.

- Choosing a loan term that doesn’t match financial goals.

- Not shopping around for better interest rates.

- Forgetting to factor in refinancing options.

Avoiding these errors ensures you get the best mortgage deal available through traceloans.com can help you find. possible.

How Do Mortgage Interest Rates Affect Your Loan Repayment?

Interest rates directly influence how much you pay over time.

- Lower rates mean smaller monthly payments and thousands in lifetime savings.

- Higher rates increase repayment amounts, stretching budgets.

- Adjustable-rate mortgages can start low but rise with market fluctuations.

That’s why Traceloans.com emphasizes comparing offers and locking in rates strategically.

Traceloans.com Mortgage Calculators

Traceloans.com provides free online mortgage calculators to help borrowers:

- Estimate monthly payments.

- Compare loan terms.

- Understand how down payment size affects affordability.

- Evaluate refinancing benefits.

These calculators empower borrowers to make informed financial decisions before committing.

How Does Traceloans.com Help First-Time Buyers Secure a Home?

First-time buyers often face challenges with limited credit history or smaller down payments. Traceloans.com supports them by offering:

- Access to FHA loans with low down payment options.

- Educational resources to explain the mortgage application process.

- Step-by-step guidance from mortgage advisors.

- Tools to compare offers from multiple lenders.

This makes homeownership more accessible. buying your first home less stressful and more affordable.

Traceloans.com vs. Other Mortgage Platforms

- Traceloans.com Login – Fast, secure, and easy for managing your loan.

- Caliber Home Loans Login – Simple and secure but lacks personalized options.

- Veterans United Login – Excellent for VA loans but limited for non-military borrowers.

When choosing a mortgage, Traceloans.com stands out for flexibility, transparency, and mortgage loans that unlock exceptional savings.

Future of Traceloans.com Mortgage Loans

The future of Traceloans.com looks promising as more borrowers shift to online lending platforms. Key trends include:

- AI-driven loan matching to connect borrowers with the best options faster.

- Expanded refinancing solutions for homeowners managing rising costs and understanding mortgage rates.

- Personalized financial tools to help borrowers manage loans beyond approval.

- Stronger digital security and login features for safe transactions.

With these innovations, Traceloans.com is set to remain a leader in digital mortgage lending.

Tips for Getting the Best Mortgage Deal

Here are tips for getting the best mortgage terms can help you save money. deal when applying for a mortgage through Traceloans.com:

- Compare mortgage offers daily.

- Lock in rates at the right time.

- Boost your credit score before applying.

- Explore shorter loan terms for long-term savings.

- Consider refinancing an existing mortgage to lower costs.

Why Traceloans.com Mortgage Loans Offer More Value

Unlike traditional banks that restrict you to their products, Traceloans.com connects borrowers to a wide network of lenders, ensuring access to:

- Competitive rates

- Transparent fees

- Tailored loan options

- A smooth online mortgage experience

Whether you’re a first-time buyer, refinancing your current mortgage, or seeking the best mortgage deal, Traceloans.com helps you unlock incredible savings with the right mortgage options available.

pros and cons of Traceloans.com and key alternatives

| Platform / Option | Pros | Cons | Best For |

|---|---|---|---|

| Traceloans.com | • User-friendly online platform with simple mortgage comparisons • Multiple loan options (Fixed-Rate, FHA, VA, ARMs, Refinance) • Fast pre-qualification with no hard credit hit • Transparent pricing and flexible approval for borrowers with limited credit | • No in-person branch support • Rates and fees can be higher for low-credit borrowers • Loan products vary by region | First-time buyers, tech-savvy borrowers, and those seeking flexible approvals |

| LendingTree (online loan marketplace) | • Compares offers from multiple lenders at once • No borrower fee • Quick access to pre-qualified quotes | • Many follow-up calls/emails from lenders • Privacy concerns with broad data sharing | Borrowers who want lenders competing for their business and fast comparisons |

| Online Mortgage Brokers / Marketplaces (general) | • Convenient 24/7 application access • Fast approvals • Lower costs than traditional banks | • Limited personalized guidance • Data security risks • May not suit complex financial profiles | Busy professionals and borrowers comfortable managing everything online |

| Traditional Banks / Credit Unions | • Face-to-face guidance from loan officers • Trusted and established institutions • Local market knowledge | • Slower processing and more paperwork • Limited loan options (only their products) | Borrowers who prefer in-person service or already bank with the institution |

| Direct Online Lenders (e.g., SoFi, Rocket Mortgage) | • Fast, seamless digital process • Competitive interest rates • Streamlined approvals | • Minimal personal guidance • Reputation varies for newer players | Borrowers who want speed, efficiency, and competitive interest rates |

| Peer-to-Peer / Fintech Marketplaces (like Credible) | • Broad selection of lenders • Easy to compare refinance and mortgage offers | • Limited personal guidance • Entirely digital interactions | Borrowers open to fintech tools who want multiple quotes for refinancing or mortgages |

user-friendly answers to your FAQs

How to verify a mortgage lender is legitimate?

Check if the lender is registered with your state’s financial authority or the Nationwide Multistate Licensing System (NMLS). Always read reviews and confirm their license number.

Who is Northstar loans?

Northstar Loans is a lending company that offers personal and short-term loans. Always review their terms carefully before borrowing.

Who owns my mortgage loan?

Your mortgage may be owned by the original lender, a bank, or an investor. You can find this information on your monthly mortgage statement or by contacting your servicer.

What are the three types of loans?

The three main types are:

Secured loans (backed by collateral)

Unsecured loans (no collateral)

Revolving loans (like credit cards or lines of credit)

Can I get a mortgage with a low credit score?

Yes, some lenders and government-backed programs like FHA loans allow approvals with lower credit scores, though interest rates may be higher.

Can I get a mortgage with a low down payment?

Yes, FHA loans, VA loans, and some first-time buyer programs let you buy a home with as little as 3%–3.5% down.

Why First-Time Buyers Should Choose Traceloans.com?

Because Traceloans.com offers low down payment options, flexible credit requirements, and easy comparisons to help first-time buyers find affordable loans.

What is the minimum deposit required for a mortgage?

The minimum mortgage terms are usually 3%–5% of the home’s value, though some VA and USDA loans may require no deposit at all.

What credit score do I need?

Most conventional mortgages require a 620+ score, but FHA loans may approve borrowers with scores as low as 580.

What Are the Common Mortgage Loan Mistakes to Avoid?

Not checking your credit score

Overlooking hidden costs

Taking on too much debt

Ignoring refinancing options

Should I choose a fixed-rate or adjustable-rate mortgage?

Fixed-rate: Best if you want stable, predictable payments.

Adjustable-rate (ARM): Good if you want lower initial payments and plan to sell or refinance before rates adjust.

Final Thoughts: Choosing the Right Mortgage in 2025

Buying your first home or refinancing your original mortgage doesn’t have to be stressful, especially when understanding mortgage options available. Traceloans.com for mortgage loans offers a modern, borrower-first approach that combines competitive rates, multiple lenders, and a simplified online platform.

In short, Traceloans.com makes home financing easier, faster, and more affordable. With mortgage loans that unlock exceptional value, Traceloans.com is more than just a lender—it’s your mortgage partner.

Traceloans.com mortgage loans offer:

✅ Transparency with no hidden fees

✅ Competitive interest rates

✅ Flexible mortgage options for every borrower

✅ Expert support for making informed decisions

If you’re ready to find the best mortgage deal, compare offers today and see how Traceloans.com mortgage loans can help you achieve your dream home.

users reviews for traceloans.com mortgage loans

⭐⭐⭐⭐⭐

“Made My First Home Purchase Easy” – Sarah J., Austin, TX

I was nervous about applying for my first mortgage, but Traceloans.com made the entire process simple. The online application was straightforward, and I loved being able to upload documents directly. Their team walked me through every step, and I ended up with an FHA loan that fit my budget. I compared three offers on their platform and saved money on closing costs. Highly recommend for first-time buyers!

⭐⭐⭐⭐☆

“Great Rates, Smooth Process” – Mark L., Orlando, FL

Traceloans.com helped me lock in a fixed-rate mortgage at 6.1% when other lenders were quoting higher. The platform was easy to use, and I got approval within a week. The only downside was that customer service sometimes took a day to respond, but overall the savings were worth it.

⭐⭐⭐⭐⭐

“Refinanced and Saved Thousands” – Priya K., San Jose, CA

I used Traceloans.com to refinance my existing mortgage. The calculators showed me exactly how much I could save, and it turned out better than expected. My new monthly payment dropped by almost $400, thanks to favorable mortgage rates. The transparency on fees gave me peace of mind—no surprises at closing.

⭐⭐⭐⭐☆

“Helpful but Could Improve Mobile App” – David M., Denver, CO

The online platform works well on a laptop, but I found the mobile version a little clunky. That said, I was still able to complete my mortgage application and get pre-qualified within minutes. Their advisors were very professional and explained loan terms clearly. Overall, very satisfied.

⭐⭐⭐⭐⭐

share“Veteran-Friendly VA Loan Support” – Jessica R., San Antonio, TX

As a veteran, I wanted to use my VA loan benefits. Traceloans.com made the process painless. They connected me with lenders who specialize in VA loans, and I didn’t have to stress about paperwork. Closing was fast, and I felt valued as a customer.

Leave a Reply