Navigating Ollo Credit Card Login and Payments with Ally Bank

Easily access your Ollo credit card account with Ally Bank. Log in online to manage payments, review transactions, and check your FICO score anytime. Looking for a credit card that’s easy to understand and helps you build or rebuild your credit without the headache of hidden fees? The Ollo Credit Card, issued by Ollo Card Services (a subsidiary of Allied Irish Banks, part of Ally Financial), might just be the no-frills solution you need. Designed for people with limited or less-than-perfect credit, this card skips the complexity of rewards programs and high penalties, offering a straightforward path to better financial health. Let’s break it down in a way that’s simple, relatable, and packed with everything you need to know.

What Makes the Ollo Credit Card Stand Out?

The Ollo Card is all about keeping things clear and affordable. Whether you’re new to credit or recovering from past financial hiccups, here’s what you’ll get:

- No Annual Fee: Many credit-building cards charge yearly fees, but Ollo doesn’t impose high penalties like that, making it budget-friendly.

- Credit Limits That Fit Your Needs: Depending on your creditworthiness, you’ll start with a credit limit between $300 and $1,000. It’s modest but flexible for beginners.

- APR Details: The variable APR ranges from 24.99% to 29.99%. It’s higher than premium cards, but typical for subprime borrowers. Pay off your balance monthly to avoid interest charges.

- No Hidden Fees: Say goodbye to foreign transaction fees, over-limit fees, or penalty APRs. Ollo keeps it transparent.

- Credit Building Made Easy: Payments are reported to all three major credit bureaus—Equifax, Experian, and TransUnion—boosting your FICO score with responsible use.

Featured Snippet: Key Benefits of the Ollo Credit Card

- No annual fee keeps costs low.

- Credit line starts at $300–$1,000 based on your profile.

- Reports to credit bureaus to improve your FICO score.

- No hidden fees for peace of mind.

Who Should Consider the Ollo Credit Card?

This isn’t your typical flashy credit card—it’s an invite-only option tailored for specific folks. You can’t just apply; Ollo sends pre-approval offers based on your credit profile. So, who’s it for?

- People Rebuilding Credit: If missed payments or bankruptcy have dinged your score, this card helps you get back on track.

- First-Time Cardholders: New to credit? The Ollo Card is a simple entry point to establish a credit line.

- No-Nonsense Users: If you don’t care about cash back or rewards and just want a reliable card, this fits the bill.

Pros and Cons of the Ollo Credit Card

Pros

- No annual fee saves you money.

- Helps improve your credit score by reporting to bureaus.

- Transparent terms—no surprises like hidden fees.

- Easy pre-approval process if you’re invited.

Cons

- High APR (24.99%–29.99%) compared to prime cards.

- No cash back or rewards like the Ollo Rewards Card (if available).

- Invite-only—you can’t enroll unless Ollo offers it.

- Lower credit limit might not work for bigger spenders.

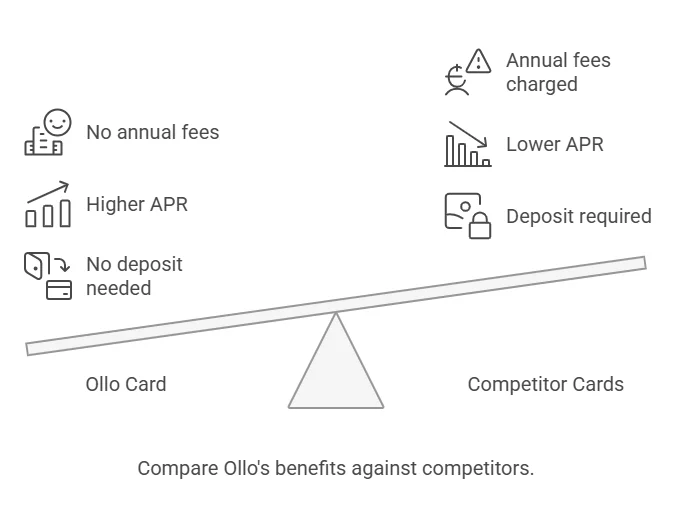

How Does Ollo Stack Up Against the Competition?

Compared to cards like the Capital One Platinum Secured Card or Discover it® Secured Credit Card, the Ollo Credit Card shines for its simplicity. Secured cards require a deposit, which Ollo skips, but they might offer lower APRs or cash back. Against unsecured options like the Credit One Bank® Platinum Visa®, Ollo’s lack of an annual fee gives it an edge. It’s not about perks—it’s about accessibility.

The Bottom Line: Is the Ollo Credit Card Right for You?

The Ollo Credit Card won’t win awards for glamour, but it’s a practical tool for building credit without breaking the bank. If you’ve received a pre-approval offer and want a card that’s easy to manage while avoiding charge any annual fees, it’s worth a look. Just keep an eye on that high APR—make payments on time and pay off your balance to dodge interest charges. Call 1-877-494-0020 for assistance if you need help!

How to Check Your Ollo Credit Card Balance

Staying on top of your card account is key to smart money management. Here’s how to check your balance with ease:

1. Online Account Access

- Head to the Ollo website at ollocard.com.

- Log in to your online account using your username and password. New user? Register with your account number and Social Security number.

- Your dashboard shows your balance, recent transactions, and available credit line.

2. Ollo Mobile App

- Download the Ollo mobile app from the App Store or Google Play.

- Sign in with your login credentials.

- Check your balance and manage your account on the go.

3. Phone Support

- Call customer service at 1-877-494-0020.

- Use the automated system or speak to a rep—have your account number ready.

4. Paper Statements

- Get your balance via monthly bank statements if you’re not on e-statements. Switch preferences in your account online.

Pro Tips

- Set up automatic alerts for balance updates or your payment due date.

- Check regularly to avoid late fees and overspending.

- Make a payment on time to keep your FICO in good shape.

Ollo and Mastercard: A Game-Changing Partnership

Big news! Ollo has teamed up with Mastercard to bring fresh, innovative credit solutions to the table. This partnership blends Ollo’s focus on underserved users with Mastercard’s global reach, promising cards that are secure, flexible, and easy to use—whether you’re shopping locally or abroad.

Expect features like competitive rates, a slick mobile app, and tools to boost your credit line increases. It’s all about empowerment, especially for those overlooked by big banks. Stay tuned for more details—this could shake up the credit card company scene!

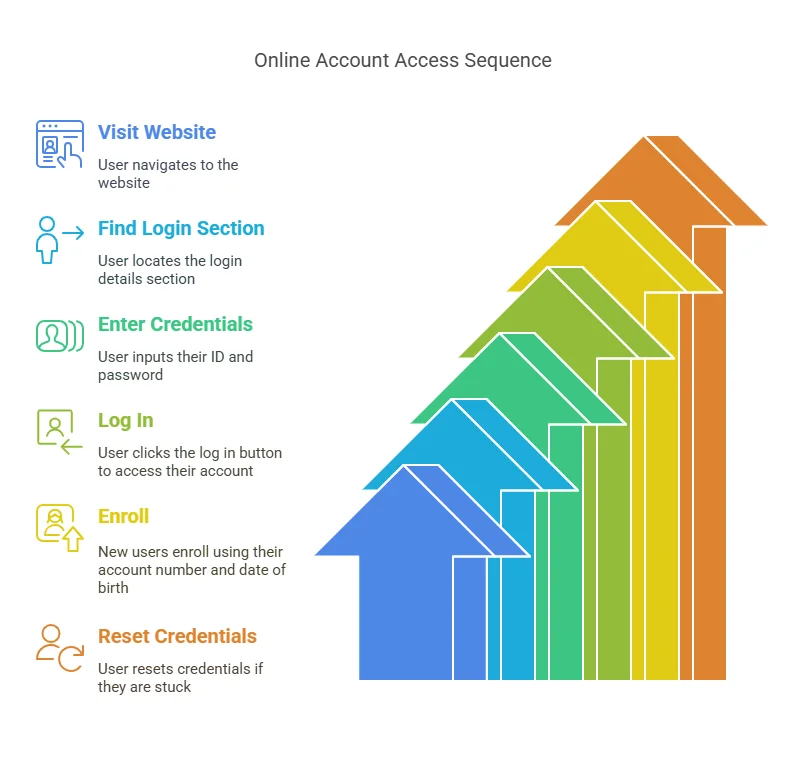

Logging In Made Simple: Ollo Credit Card Login Guide

Accessing your Ollo credit card account is a breeze. Here’s how to get to the Ollo credit card login page:

- Visit card.ally.com in your browser.

- Find the login section (usually top right).

- Enter your user ID and password.

- Click “Log In” to see your card credit details.

Forgot your credential? Hit “Forgot Username or Password?” to reset it. New users can enroll by registering with their card info and date of birth. The login process is smooth, secure, and perfect for quick account management.

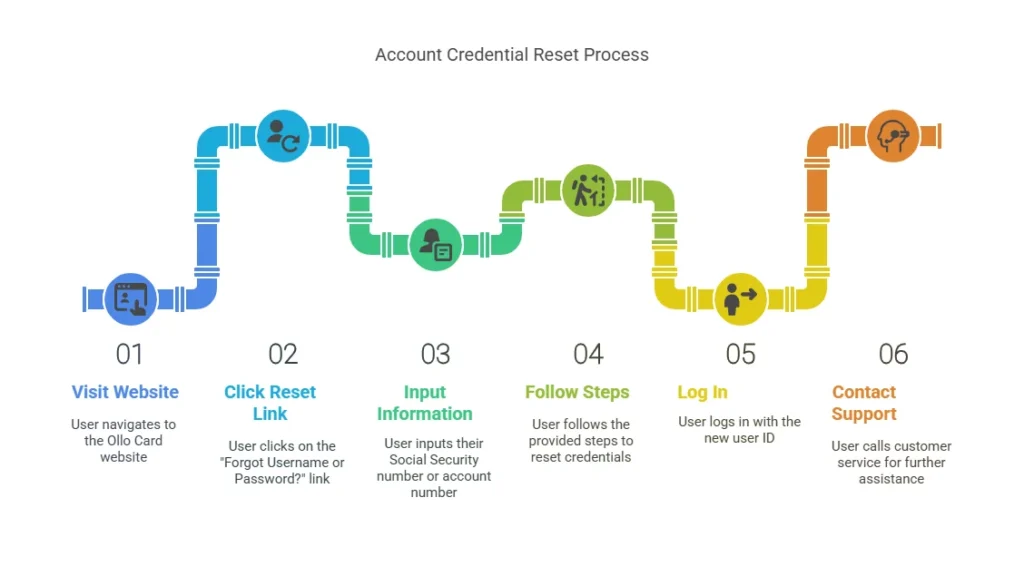

How To Reset Ollo Credit Card Login User ID?

Locked out of your Ollo credit card login? Don’t sweat it—resetting your user ID or password is simple. Here’s how:

- Go to card.ally.com and head to the card login details section.

- Click “Forgot Username or Password?” below the login fields.

- Enter your account number or Social Security number and date of birth as prompted.

- Follow the instructions to reset your credential—you’ll get a new user ID or temporary password via email or text.

- Log in with your new details and update them if needed.

For extra help, call customer service at 1-877-494-0020. It’s a quick fix to get you back into your account online!

Ollo Cards Will Be Converted to Ally Cards Starting in June

Heads up, Ollo cardholders! Starting in June 2025, your Ollo cards will transition to Ally cards as part of a broader shift under Ally Bank and Ally Financial. This means your existing Ollo card will become an Ally credit card, potentially bringing new perks or changes to your terms and conditions.

What to expect? Your credit limit, balance, and payment due date should carry over, but keep an eye on updates about APR, ways to pay, or benefits of the Ollo evolving into Ally’s offerings. Check your billing statements or the Ollo website for specifics, and don’t hesitate to call 1-877-494-0020 for clarification from customer support. It’s a smooth handoff to the new Ally era!

Final Thoughts

The Ollo Credit Card is a solid pick if you’re after simplicity and credit-building power. From its no annual fee perk to easy ways to make payments, it’s built for real people—not just perfect credit scores. Ready to dive in? Visit the portal, log in to your account, and take charge of your finances today. Have questions? Call customer service at 1-877-494-0020 or check the FAQs online! Whether you stick with Ollo or transition to an Ally card, you’re in good hands.

Ollo Credit Card FAQs: Answered Simply

Who owns the Ollo Credit Card?

The Ollo Credit Card is now part of the Ally Financial family. Ally Bank, a well-known online banking giant, took over Ollo Card Services in October 2022. Before that, the card was issued by The Bank of Missouri, but now it’s all under Ally’s umbrella, headquartered in Detroit, Michigan.

Anyone else having issues with the Ally Credit Card (formerly Ollo)?

You’re not alone if you’ve hit some bumps with your Ally Credit Card after the switch from Ollo! Some folks have reported hiccups—like trouble downloading transactions into apps like Quicken or delays with their new Ally card working smoothly. It seems the transition starting in June 2025 has caused a few headaches. If you’re dealing with this, try calling Ally’s customer service at 1-888-366-2559 to sort it out—they’re available 24/7.

How to Check Your Ollo Credit Card Balance?

Checking your Ollo Credit Card balance is a breeze with these options:

Online: Visit www.ollocard.com (or card.ally.com post-transition), log in with your username and password, and peek at your dashboard.

Mobile App: Download the Ollo mobile app (or Ally Banking app after June 2025) from the App Store or Google Play, sign in, and your balance is right there.

Phone: Call 1-877-494-0020 (or 1-888-366-2559 for Ally), follow the prompts, and use your account number to hear your balance.

Mail: Check your monthly statement if you’re not on e-statements—your balance is listed there.

How to Pay Your Ollo Credit Card?

Paying your Ollo Credit Card is super flexible:

Online: Log in at www.ollocard.com, go to “Make a Payment,” add your bank info, pick an amount, and submit.

App: Open the Ollo mobile app, tap “Make a Payment,” verify your details, and send it off.

Phone: Dial 1-877-494-0020, have your account number ready, and pay with a rep or the automated system.

Mail: Send a check (with your account number written on it) to Ally Credit Card, PO Box 660371, Dallas, TX 75266-0371—mail it 7-10 days early to beat the due date.

Set up automatic payments online to make it even easier!

Does Ollo allow cash advances?

Nope, the Ollo Credit Card doesn’t offer cash advances right now. It’s designed more for building credit than giving you quick cash access. After the switch to Ally in June 2025, check your new Ally card terms—some Ally cards might allow it with a fee (like $10 or 5% of the advance), but it’s not guaranteed.

Do you have multiple accounts with Ally?

This one’s on you! Ally offers savings, checking, and credit card accounts, so you might have more than one. If you’re an Ollo cardholder, your card is now an Ally credit card. Log in to card.ally.com or call 1-888-366-2559 to see all your accounts linked to your name or Social Security number.

How to Register for Online Access to Your Ollo Card?

New to online access? Here’s how to get started:

Go to www.ollocard.com (or card.ally.com after June 2025).

Click “Enroll” or “Register” under the login section.

Enter your account number, Social Security number, and date of birth.

Set up your username and password.

Confirm your settings, and you’re in! Now you can manage your account anytime.

How do I activate my Ollo Card?

Got a new Ollo Card? Activating it is simple:

Online: Log in to www.ollocard.com, find the activation option, and follow the prompts.

Phone: Call 1-877-494-0020, provide your card details, and it’s ready to go.

Post-June 2025, your new Ally card might arrive already active, but if not, use 1-888-366-2559 or card.ally.com.

How do I set up paperless billing for my credit card?

Going paperless is eco-friendly and clutter-free:

Log in to your online account at www.ollocard.com (or card.ally.com later).

Head to “Account Settings” or “Billing Preferences.”

Switch to e-statements and save your choice.

You’ll get email alerts instead of paper—access up to 24 months of statements online!

How to Avoid Late Fees?

Nobody likes late fees! Here’s how to dodge them:

Pay by the due date—check it on your statement or app.

Set up automatic payments online so you never forget.

Pay at least the minimum payment if you can’t clear the full balance.

Use reminders via the app or calendar to stay on track. Ollo (and Ally) won’t hike your APR for late payments, but a fee could still sting.

What to Do If You Forget Your Ollo Credit Card Login Password?

Forgot your password? No stress:

Go to www.ollocard.com and click “Forgot Username or Password?”

Enter your account number or Social Security number and follow the steps.

Reset your credential via email or text, then log in again.

Need help? Call 1-877-494-0020 (or 1-888-366-2559 post-transition).

What is the minimum payment on an Ollo Card?

The minimum payment on your Ollo Card depends on your balance and terms—usually a small percentage (like 1-3%) of your total balance plus any interest or fees. Check your statement or log in to see the exact amount. After June 2025, your Ally card will list it clearly online or on your app.

What is the exact institution name being used for your Ollo Card in your Quicken account?

In Quicken, your Ollo Card likely shows up as “Ally Bank” now, since Ally took over in 2022 and the transition completes in June 2025. Before, it might’ve been “The Bank of Missouri” or “Ollo Card Services.” To confirm, go to Tools > Account List in Quicken and look at the connection details—it should say “AllyBank” with a link to www.ally.com.

Got More Questions?

These answers should get you started, but if you’re still curious, hit up customer support at 1-877-494-0020 (Ollo) or 1-888-366-2559 (Ally). Whether it’s managing your credit line, checking recent transactions, or sorting out billing, they’ve got your back!

0 Comments on “Navigating Ollo Credit Card Login and Payments with Ally Bank”