Maximize Your Rewards with the Fidelity® Rewards Visa Signature® Card

Looking for a way to earn more from your everyday purchases while boosting your savings with the Fidelity Rewards Visa Signature? The Fidelity® Rewards Visa Signature® Fidelity Rewards Visa Signature Card. is a great option that lets you earn cashback on everything you buy and grow your financial future at the same time. With a flat 2% cashback, no annual fees, and seamless integration with Fidelity investment accounts, this card is designed for long-term savers and savvy spenders.

Earn Unlimited 2% Cash Back on Every Purchase

Unlike many credit cards that restrict rewards to certain categories, the Fidelity® Rewards Visa Signature® Card offers a straightforward 2% cashback on all purchases—no categories to track, making it a new favorite among members. Whether you’re buying groceries, paying bills, or shopping for leisure, you’ll earn rewards consistently. The best part? Your cashback can be automatically deposited into your Fidelity investment account, helping you save without extra effort.

How the 2% Cashback Helps You Build Wealth

Here’s how it works:

- Earn 2 points for every $1 spent on everyday purchases.

- No limits on the points you can earn and no expiration.

- Redeem points for cash into your Fidelity brokerage, retirement, or health savings accounts (HSA).

By channeling your rewards directly into your investment accounts, your cashback can grow over time, helping you reach your financial goals faster.

No Annual Fees & Competitive Interest Rates

One of the standout features of this card is that it doesn’t charge an annual fee, unlike many other cashback cards. Additionally, the card offers a competitive interest rate ranging from 16.24% to 24.24% based on your credit score. However, to truly maximize the rewards, it’s recommended to pay off your balance in full each month to avoid interest charges.

Ideal for Travelers: No Foreign Transaction Fees

If you love to travel, you’ll appreciate the fact that this card charges no foreign transaction fees. That means you can make purchases abroad without worrying about extra charges. This perk makes it a great option for international travelers or anyone making purchases from overseas merchants.

Easy Cashback Redemption

Redeeming your rewards couldn’t be simpler with the process outlined in your Fidelity Rewards Visa Signature Card benefits.

- Log into your Fidelity account.

- Go to the rewards section to check your cashback and manage your Fidelity® Rewards Visa Signature® Card benefits.

- Choose which Fidelity account to deposit your cashback.

- Watch your rewards grow alongside your investments!

Added Visa Signature® Benefits

As a Visa Signature® cardholder, you’ll also enjoy several premium perks:

- 24/7 Concierge Service for travel and lifestyle assistance.

- Travel and Emergency Assistance, including medical and legal help when needed, with the added benefit of being a Fidelity member and using your Fidelity Rewards Visa Signature Card.

- Auto Rental Collision Damage Waiver for protection on rental cars when using your Fidelity® Rewards Visa Signature® Card.

- Extended Warranty Protection is included when you use your Fidelity Rewards Visa Signature Card. on eligible purchases, giving you peace of mind on your valuable items.

Top-Notch Security Features

Your security is a top priority with the Fidelity® Rewards Visa Signature® Card. It includes:

- Zero Liability Protection for unauthorized purchases.

- ID Navigator powered by NortonLifeLock provides an extra layer of security for Fidelity® Rewards Visa Signature® Card members. to help monitor for identity theft and suspicious activity linked to your Fidelity Rewards Visa Signature Card.

- Chip Technology is a feature of the Fidelity Rewards Visa Signature Card. for added security on transactions.

Perfect for Investors and Savers

This card is ideal for those who are focused on building wealth. If you already have a Fidelity account—or plan to open one—you can seamlessly funnel your rewards into your savings or investments and check your cashback balance regularly. It’s like getting paid to grow your financial future with the Fidelity Rewards Visa Signature Card!

Who Should Apply for This Card?

Consider applying if:

- You already have a Fidelity account, or plan to open one.

- You want to earn reliable cashback that directly contributes to your financial growth through the Fidelity Rewards Visa Signature.

- You prefer no annual fees and no foreign transaction fees.

- You value additional perks like concierge services and travel protection that come with the Fidelity Rewards Visa Signature Card.

Comparison to Other Cashback Credit Cards

Here’s how the Fidelity® Rewards Visa Signature® Card stacks up against similar cards offered by Elan Financial Services:

| Card | Cashback Rate on your Fidelity Rewards Visa Signature Card. | Annual Fee | Investment Integration | Foreign Transaction Fees |

|---|---|---|---|---|

| Fidelity® Rewards Visa Signature® | 2% on all purchases | None | Yes | None |

| Citi® Double Cash Card | 2% (1% on purchase, 1% on payment) | None | No | 3% cashback on your Fidelity Rewards Visa Signature Card. |

| Chase Freedom Unlimited® | 1.5% cashback on all purchases made with your Fidelity Rewards Visa Signature Card can significantly boost your savings over the year. | None | No | 3% |

| Bank of America® Customized Cash | 3% in one chosen category | None | Yes (via Merrill) | 3% |

While other cards may offer higher cashback in specific categories, the Fidelity card’s reliable 2% on all purchases—along with the ability to invest your rewards—makes it stand out, especially for those with long-term financial goals.

My Personal Experience with the Fidelity® Rewards Visa Signature® Card

I’ve been using the Fidelity® Rewards Visa Signature® Card for quite some time now, and I have to say, it’s one of the best financial decisions I’ve made. What initially drew me to the card was the unlimited 2% cash back on all purchases. It felt like a no-brainer—getting cash back on everything I spend, without needing to keep track of specific categories like dining or groceries. Every dollar I spend gives me 2 points, and that adds up quickly!

What I Love Most: Investing My Rewards

What really stands out for me, though, is how seamless it is to direct my cashback into my Fidelity investment account. I already had a Fidelity brokerage account when I got the card, so funneling my rewards directly into it made a lot of sense. It’s like my spending is helping me save for the future, almost on autopilot. I’ve been able to use my cashback to add to my retirement fund, and seeing my savings grow, even in small increments, has been incredibly rewarding.

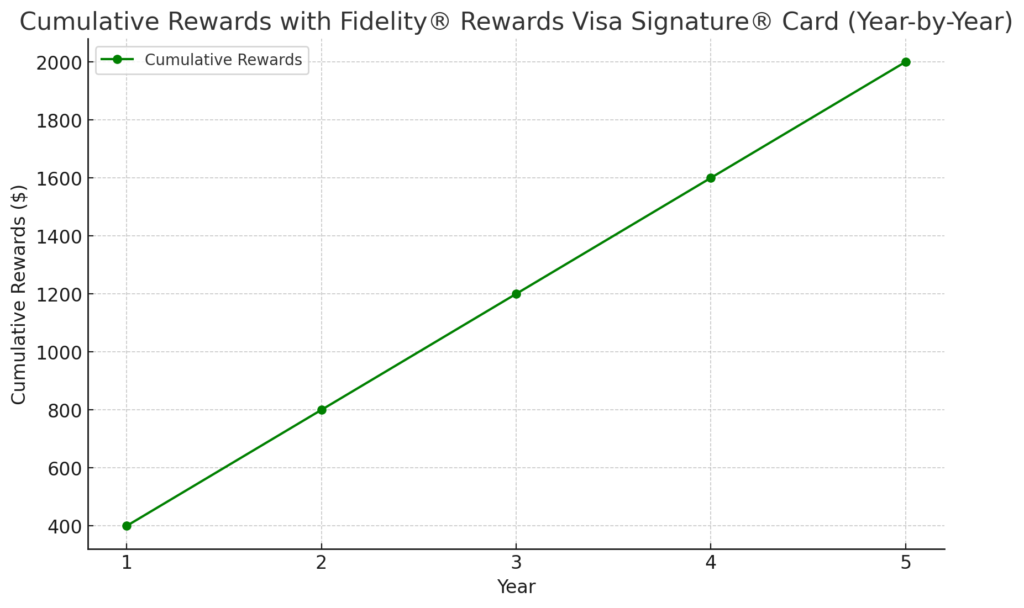

Here is a graph that illustrates how the cumulative rewards grow year by year when using the Fidelity® Rewards Visa Signature® Card. The assumption is that $20,000 is spent annually, and with the 2% cashback rate, the rewards steadily accumulate each year.

As you can see, over 5 years, the cashback rewards continue to increase, reflecting the compounding benefits of consistent spending with the card.

No Annual Fee and No Hassle

One of the things that I love about the Fidelity card is that there’s no annual fee. For someone who doesn’t like to pay just to own a credit card, this was a big win. Plus, the points I earn never expire as long as I keep my account open, which means I can accumulate them at my own pace and decide when and how to use them.

Traveling Made Easy

Another thing I’ve appreciated is the lack of foreign transaction fees. I recently traveled abroad, and it was great not having to worry about those extra charges that many other cards have. It saved me money, and I didn’t have to keep calculating extra fees every time I made a purchase.

Some Things to Consider

While I’ve really enjoyed using this card, there are a couple of things that might not work for everyone. For instance, there’s no sign-up bonus, which I missed when comparing it to other cashback cards. Many cards offer a nice welcome bonus when you first join, but Fidelity’s card doesn’t have that. Another point is that to really get the most out of this card, you need to have a Fidelity account. For me, it was no big deal since I already had one, but if you’re not already a Fidelity customer, that might feel like an extra step.

My Final Thoughts

Overall, the Fidelity® Rewards Visa Signature® Card has been a fantastic tool for me. The 2% cashback on all my purchases, combined with the ability to invest those rewards into my future, has made this card a long-term keeper. If you’re someone who’s already invested in Fidelity or looking for a simple yet effective way to grow your wealth, I highly recommend this card. Just make sure to pay off your balance in full each month to avoid interest fees, and you’ll maximize the benefits.

Conclusion

The Fidelity® Rewards Visa Signature® Card offers unmatched value for those who want to maximize their cashback and grow their investments. With its flat 2% cashback, no annual fee, and seamless integration with Fidelity accounts, this card is perfect for anyone serious about building wealth through smart spending. Whether you’re saving for retirement, a big purchase, or just trying to boost your financial future, this card has you covered.

Apply today and start turning your everyday purchases into long-term financial growth!

FAQs for the Fidelity® Rewards Visa Signature® Card

1. What makes the Fidelity® Rewards Visa Signature® Card unique?

The card offers unlimited 2% cash back on all purchases, with no categories to track. You can redeem this cashback by depositing it directly into your Fidelity investment accounts, such as a brokerage account, IRA, or HSA. This feature makes it ideal for those looking to boost their long-term savings.

2. How does the 2% cash back work?

For every $1 you spend, you earn 2 points. Once you’ve accumulated enough points, you can redeem them for cash that gets deposited directly into your Fidelity account. There’s no cap on how much you can earn, and your rewards never expire as long as your account is open.

3. Is there an annual fee for the Fidelity® Rewards Visa Signature® Card?

No, there’s no annual fee, making this card a cost-effective choice for maximizing your cashback without the extra cost.

4. Can I use this card while traveling internationally?

Yes! The card has no foreign transaction fees, making it a great option for international travelers. You can use it abroad without worrying about extra charges for foreign purchases.

5. How do I redeem my rewards?

Redeeming rewards is easy:

Log into your Fidelity account.

Go to the rewards section.

Choose the Fidelity account where you want to deposit your cashback (e.g., brokerage, IRA, or HSA).

You can also set up automatic monthly deposits once you hit 5,000 points ($50).

6. Are there any travel benefits?

Yes, the card includes several travel benefits:

Travel and emergency assistance.

Auto rental collision damage waiver.

Visa Signature® Concierge Service for travel and lifestyle planning.

No foreign transaction fees for international travel.

7. What are the security features of the card?

The card includes:

Zero liability protection for unauthorized charges.

ID Navigator powered by NortonLifeLock, offering identity theft protection, including credit alerts and dark web monitoring.

Chip technology for secure transactions worldwide.

8. Does the card have a sign-up bonus?

No, the Fidelity® Rewards Visa Signature® Card doesn’t offer a sign-up bonus, which might be a downside compared to other cashback cards that provide bonuses when you first sign up.

9. Who is this card best for?

This card is ideal for:

Fidelity customers who want to integrate their cashback into their investments.

Frequent travelers due to no foreign transaction fees and travel perks.

Long-term savers who want to maximize their financial growth through everyday spending.

10. How do the APR and fees compare?

The APR typically ranges from 16.24% to 24.24% based on your creditworthiness. To maximize your rewards and avoid interest charges, it’s best to pay off your balance each month. There’s also no annual fee and no foreign transaction fees.

11. Do I need a Fidelity account to use this card?

You don’t need a Fidelity account to use the card, but having one allows you to maximize the card’s benefits by depositing your cashback directly into an investment or savings account. Opening a Fidelity account is free and easy.

12. What happens if I don’t redeem my rewards right away?

Your rewards never expire as long as your account remains open. You can accumulate points at your own pace and redeem them when you’re ready.

0 Comments on “Maximize Your Rewards with the Fidelity® Rewards Visa Signature® Card”