How to Challenge a Debt Lawsuit and Get Your Credit Card Debt Dismissed

Learn how to challenge a debt lawsuit, negotiate with creditors, and leverage your legal rights to get a debt lawsuit dismissed and avoid a judgment. If you are Credit Card user and you Facing a debt lawsuit can feel overwhelming, but knowing your rights and taking the right steps can help you navigate the legal process and even get the case dismissed. This guide breaks down actionable strategies to empower you in dealing with debt lawsuits effectively.

Understanding Debt Lawsuits

A debt lawsuit begins when a creditor or a debt collection agency sues you for unpaid debts, such as credit card balances or personal loans. If left unaddressed, these lawsuits can result in A default judgment can severely affect your credit and may result from not responding to the lawsuit.s, leading to wage garnishment, bank account levies, or property liens.

Key Components of a Debt Lawsuit

- Complaint: A legal document outlining the creditor’s claims.

- Summons: A notice requiring your response to the lawsuit.

- Answer: Your official reply to the lawsuit, listing your defenses or counterclaims.

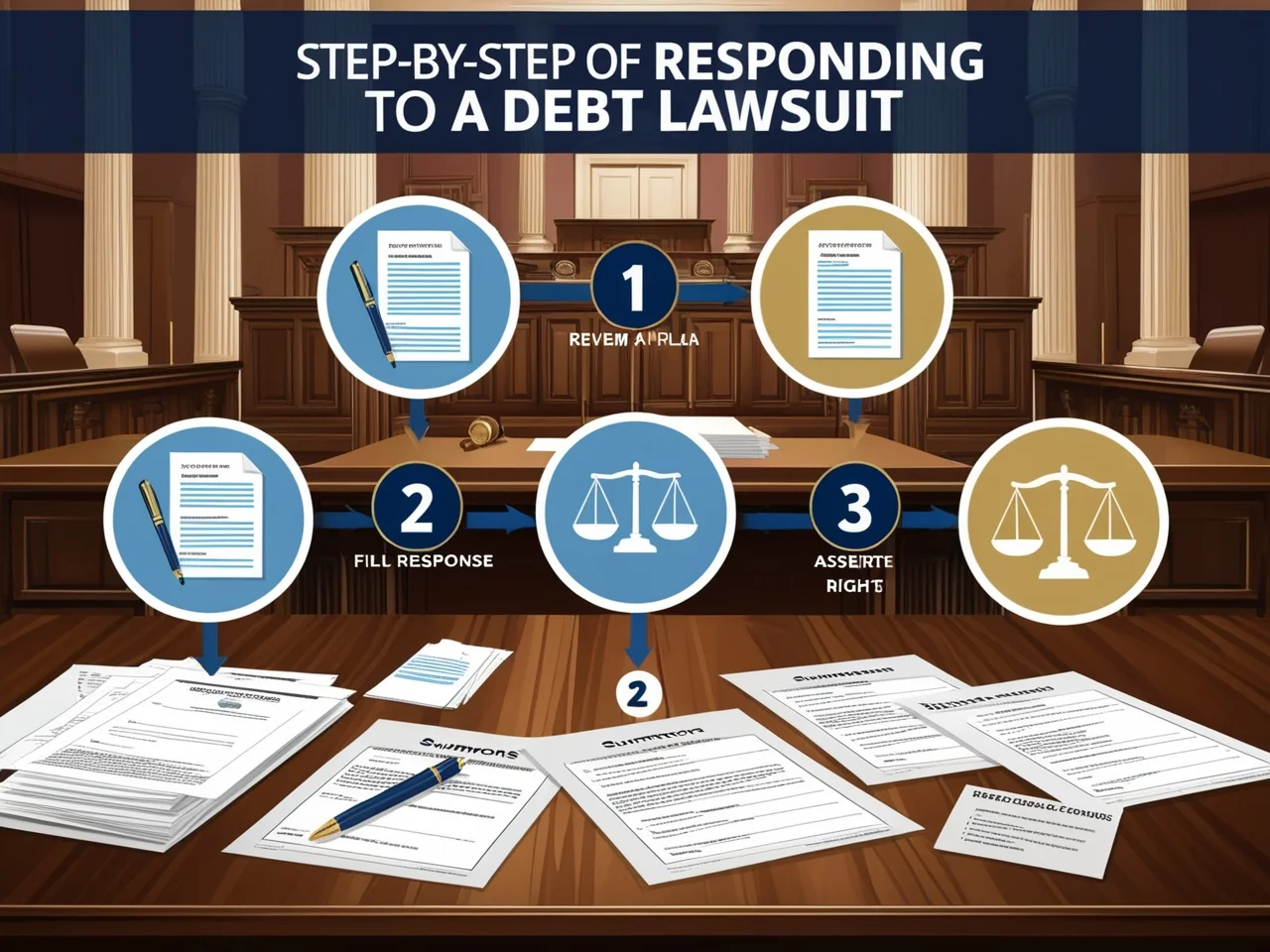

How to Respond to a Debt Lawsuit

Responding promptly and accurately is critical to avoid a default judgment.

Step 1: Review the Lawsuit Documents

- Verify the debt: Check the accuracy of the debt amount and creditor details.

- Confirm ownership: Ensure the debt is yours and not due to identity theft or an error.

Step 2: File an Answer

- Respond within the court’s deadline (usually 20–30 days).

- Include defenses like:

- Statute of limitationsIf the debt is time-barred, you may respond to the lawsuit with a valid defense.

- Mistaken identity: If the debt doesn’t belong to you.

- Incorrect amount: If the claim includes unauthorized fees.

Step 3: Gather Evidence

- Collect essential documents, including:

- Loan agreements.

- Payment receipts.

- Review your credit card statements to ensure the amount of the debt is accurate before responding to the lawsuit.

Strategies How to Get a credit card Debt Lawsuit Dismissed

1. Challenge the Creditor’s Standing

Creditors must prove they own the debt and have the legal right to sue. Request:

- Proof of debt ownership.

- Chain of title if the debt was sold to a collection agency.

2. Assert the Statute of Limitations

Debts have a limited timeframe for legal action, varying by state. If the creditor missed this window, the case can be dismissed.

3. Highlight Procedural Errors

Common errors include:

- Improper service of summonsIf you weren’t served correctly, you should respond to the lawsuit to protect your rights.

- Wrong jurisdictionIf the lawsuit was filed in the wrong court, you should respond to the lawsuit and seek legal advice.

4. Dispute the Debt Amount

Demand validation of the debt to ensure the plaintiff is attempting to collect the debt legally. If the creditor cannot provide accurate documentation, the case may be dismissed.

Negotiation and Settlement Options

If dismissal isn’t possible, consider negotiation to reduce the financial burden:

- Debt Settlement: Offer a lump-sum payment lower than the total amount owed.

- Payment Plan: Arrange smaller, manageable monthly payments to avoid negative impacts that affect your credit.

- Mediation: Work with a neutral mediator to resolve the dispute outside court.

Do You Need to Respond While Negotiating?

Yes! Even if you’re negotiating payments, you must file a written response with the court to avoid a default judgment.

Key Steps:

- File an Answer with the court.

- Confirm any dismissal agreement in writing if negotiations succeed.

- Keep records of all communications with the creditor.

Should You Hire an Attorney?

While self-representation is possible, hiring a debt defense attorney can strengthen your case. They can:

- Identify legal defenses.

- File motions to dismiss.

- Negotiate settlements.

Preventing Debt Lawsuits in the Future

- Communicate with Creditors: Proactively address payment issues to avoid legal action.

- Monitor Credit Reports: Dispute errors to prevent wrongful lawsuits.

- Budget for Debt Repayment: Avoid delinquency by managing finances carefully.

My Personal Experience Handling a Debt Lawsuit

When I first received a summons for a debt lawsuit, I was overwhelmed and unsure of where to begin. Like many, I had no legal background and felt completely out of my depth. However, through persistence and careful planning, I was able to navigate the process successfully.

The Initial Shock and Reality Check

Opening the envelope, I saw a complaint from a creditor claiming I owed a debt that had supposedly gone unpaid. My first reaction was panic—how could this happen? I wasn’t even sure the debt was mine. After taking a deep breath, I decided to tackle the issue head-on.

Step 1: Understanding the Lawsuit

The first thing I did was carefully review the documents. I noticed discrepancies in the amount owed and the creditor’s details, which gave me a starting point. I realized it was essential to respond promptly to avoid a default judgment. Ignoring the summons would only make matters worse.

Step 2: Filing My Response

Filing my response was intimidating. I researched online and learned that I needed to deny claims I believed were false and assert any defenses I had, such as the statute of limitations. Using court-provided forms, I carefully drafted my Answer and filed it within the 20-day deadline.

Step 3: Gathering Evidence

To build my defense, I dug through old records. I found receipts for payments made years ago, emails with the creditor, and even statements that contradicted their claim. This step was crucial—I couldn’t rely on my word alone; I needed proof.

Step 4: Challenging the Creditor

Armed with my evidence, I decided to challenge the creditor’s standing. I requested a debt validation letter, which required them to prove they owned the debt and had the right to collect it. To my surprise, they couldn’t provide complete documentation, which significantly weakened their case.

Step 5: Negotiating a Settlement

While waiting for the court date, I reached out to the creditor’s attorney to negotiate. I offered a reduced lump-sum payment, which they accepted. This allowed me to resolve the issue without the stress of going to trial. Importantly, I ensured the settlement agreement was in writing and filed with the court to officially dismiss the lawsuit.

Lessons Learned

This experience taught me valuable lessons:

- Never ignore a lawsuit: Even if you’re unsure of the debt, responding is critical to protect your rights.

- Know your rights: Understanding consumer protection laws, like the FDCPA, along with seeking legal advice can give you a strong defense.

- Stay organized: Keeping records of all payments and correspondence can make or break your case.

A Word of Encouragement

If you’re facing a debt lawsuit, know that you’re not alone. While it’s a challenging experience, with the right approach and persistence, you can navigate the process and even achieve a favorable outcome. Whether through dismissal or settlement, taking control of your financial situation is always worth the effort. Does this align with your experience, or would you like me to adjust the tone or focus?

Key Terms to Know

- Default Judgment: A ruling against you if you fail to respond.

- Statute of Limitations: The time limit for filing a debt lawsuit.

- Debt Validation: Verifying the legitimacy of the debt.

- Motion to Dismiss: A legal request to dismiss the case.

- Fair Debt Collection Practices Act (FDCPA): A law protecting you from abusive collection practices.

Take Charge of Your Financial Situation

Dealing with a debt lawsuit doesn’t have to mean defeat. By responding promptly, asserting your rights, and exploring dismissal strategies, you can take control of the situation and work toward financial freedom.

FAQs: Dealing with Debt Lawsuits

How Resolve Debt?

Resolving debt starts with understanding your financial situation and exploring your options. Here are some steps to help:

Assess Your Debt: List all your debts, including amounts, due dates, and creditors.

Create a Plan: Set a budget to prioritize payments. Consider starting with high-interest debts.

Negotiate: Many creditors are open to settlements or payment plans.

Seek Professional Help: Debt relief programs or credit counseling services can guide you.

Stay Consistent: Regular payments build trust with creditors and improve your financial stability.

How to Challenge a Debt Lawsuit

Challenging a debt lawsuit involves asserting your legal rights and questioning the validity of the claim. Follow these steps:

File a Response: Submit an Answer to the court, denying incorrect claims and raising defenses (e.g., expired statute of limitations).

Request Proof: Ask the creditor for documentation that proves you owe the debt.

Check the Details: Ensure the lawsuit isn’t based on errors like mistaken identity or inflated amounts.

Highlight Errors: Look for procedural mistakes, such as improper service or wrong jurisdiction, to strengthen your defense.

Consider legal help to navigate the complexities of being sued by a debt collector. A debt attorney can help you navigate the legal process effectively.

Understanding Debt Lawsuits

Debt lawsuits occur when a creditor or collection agency sues you to recover unpaid debts. These lawsuits often involve credit card debt, medical bills, or personal loans.

What to Expect: You’ll receive a complaint and summons outlining the claims and requiring a response.

Risks: Ignoring the lawsuit can lead to a default judgment, allowing creditors to garnish wages or seize assets.

Your Rights: You can dispute incorrect claims, negotiate, or even get the case dismissed if the creditor lacks proof.

Why You Must Respond to a Debt Lawsuit

Failing to respond to a debt lawsuit can have serious consequences. Here’s why you must take action:

Avoid Default Judgment: Ignoring the lawsuit means the court will likely rule in favor of the creditor.

Preserve Your Rights: Filing a response lets you present your defenses, such as expired statute of limitations or incorrect amounts of the debt.

Show Good Faith: Responding signals that you’re taking the matter seriously, which can help in negotiations or settlements.

What Happens If I Ignore a Summons?

Ignoring a summons is risky and often leads to negative outcomes:

Default Judgment: The court may rule against you without hearing your side.

Wage Garnishment: Creditors can garnish your wages or seize assets to recover the debt.

Credit Impact: Judgments can severely damage your credit score.

What to Do Instead: Respond to the summons by filing an Answer with the court and exploring your legal options.

What Happens If I Don’t Show Up to Court for a Debt Lawsuit?

Missing your court date can have serious repercussions:

Default Judgment: The court will likely rule in favor of the creditor.

Collection Actions: This can lead to wage garnishment, bank account levies, or liens on your property.

Limited Recourse: You lose the chance to present defenses or negotiate.

Solution: Always appear in court or notify the court in advance if rescheduling is necessary.

Can I Negotiate a Settlement After Being Served?

Yes, you can negotiate a settlement even after being served with a lawsuit. Here’s how:

Contact the Creditor: Reach out to discuss payment options, such as a lump-sum settlement or a payment plan.

Document Everything: Keep written records of all agreements.

Don’t Skip Court: Even if you’re negotiating, file an Answer to avoid a default judgment.

Consider mediation as a way to negotiate the full amount with the creditor or their attorney. A neutral mediator can help both parties reach a fair agreement outside of court.

What happens if I don’t respond to a debt lawsuit?

If you fail to respond, the court may issue a default judgment against you. This allows the creditor to pursue collection actions such as garnishing your wages, levying your bank account, or placing liens on your property.

Do I need an attorney for a debt lawsuit?

While it’s possible to represent yourself, hiring an attorney is highly recommended. An experienced lawyer can help:

Identify defenses and seek legal advice to file motions effectively.

Negotiate settlements.

Ensure procedural compliance to protect your rights.

How can I prove the debt isn’t mine?

To dispute the debt, request debt validation. The creditor must provide documentation proving:

You owe the debt.

They have the right to collect it (ownership of the debt).

If they cannot provide this proof, the lawsuit may be dismissed.

What is a motion to dismiss, and when should I file one?

A motion to dismiss is a legal request to terminate the lawsuit before trial. File this if:

The statute of limitations has expired.

The creditor lacks standing to sue.

There are procedural errors in the lawsuit.

0 Comments on “How to Challenge a Debt Lawsuit and Get Your Credit Card Debt Dismissed”