CUP Loan program Everything You Need to Know in 2025

Discover the CUP Loan Program, a USDA initiative offering low-interest loans and flexible repayment options to support students in rural areas with financial assistance. When you’re in a financial pinch and need quick cash, a Cup Loan programs are a legitimate option for many individuals. could be the answer. Unlike traditional bank loans that seem to take forever with all the paperwork and credit checks, Cup Loans offer a much simpler and faster process, making them a preferred type of loan. From my own experience, I found that these loans are perfect when you need money urgently but want to avoid the red tape.

What Exactly Is a Cup Loan Program?

The loan application process for the Cup Loan Program is designed to be straightforward and accessible for all applicants. Cup Loan Program is essentially a type of short-term loan that allows individuals to get funds quickly, usually within a day or two. Whether you’re dealing with an unexpected car repair or just need some extra cash To cover bills, Cup Loans provide a fast solution that can help secure the loan you need.

Here’s why I found Cup Loans to be helpful in achieving financial stability.

Flexibility: The loan program can provide flexibility in managing your finances. You can use the loan for anything—medical bills, home repairs, or even a spontaneous trip. The money gets deposited directly into your bank account, ready for immediate use.

Quick Approval Process: The loan application process is straightforward and efficient, providing the loan in a timely manner. Unlike bank loans, where you need to wait for days or weeks, most Cup Loan applications are approved within 24 hours.

Minimal Requirements: All you typically need is to be at least 18 years old, have proof of income, valid identification, and an active bank account.

The Cup Loan Program is a lending service that provides short-term loans to qualified borrowers in rural areas. The program is designed to help people who have emergency expenses or unexpected financial needs, especially in 2024.

To qualify for a cup loan, you must be a US citizen or permanent resident, have a regular source of income and have a valid checking account. You will also need to provide some personal information, such as your Social Security number and date of birth.

You’ve probably heard about the Cup Loan Program and wondering if the program application is legitimate or a scam. You’ve come to the right place.

How Does the Cup Loan Program Work?

Applying for a Cup Loan was super easy for me. I just filled out an online application with some basic information—like my income details and ID proof. After approval, the money was deposited into my account the next day, facilitating the loan process smoothly. Here’s a quick breakdown of how it works:

- Application: The Cup Loan Program is like a flexible option for those seeking financial assistance. You provide basic personal details and financial information.

- Approval: Once approved, the funds are transferred directly to your bank.

- Repayment: The repayment terms for the Cup Loan program can include low-interest loans that make it easier for borrowers to manage their finances. Terms vary depending on the lender, but repayments usually happen within a few weeks to a few months.

Eligibility Criteria of the Cup Loan Program application

To qualify for this loan, your businesses must meet the following criteria outlined in your business plan, as the program focuses on specific requirements.

- They must be a for-profit entity.

- They must be located in the United States.

- They must have less than $15 million in tangible net worth and less than $5 million in average net income after taxes for the previous two years.

- They must have been in operation for at least two years.

- They must have demonstrated the ability to repay the loan.

You’ve probably heard about the Cup Loan Program and wondering if the program application is legitimate or a scam. You’ve come to the right place.

We will be writing a review about the Cup Loan Program and sharing all the details you need to know about its financial stability. Continue reading below.

Table of Contents: FAQs about the Cup Loan Program can be found in the table of contents, which includes information on cup loans are generally favorable.

What is Cup Loan Program?

According to the video making rounds on Facebook, the Cup loan program stands specifically designed to help people struggling to pay bills.

The payment can be used for home repairs, a new car, pay for a wedding, school tuition, and rent, the video claims.

It’s also claimed that you can borrow as much as $50,000 with flexible terms, and qualifying will not affect your credit score.

Is the Cup Loan Program application real and legit?

From my experience, yes, Cup Loans are legit, but it’s important to read the fine print regarding the terms set by the department of agriculture. Always compare rates and terms between lenders to make sure you’re not getting hit with unexpected fees or high interest rates.

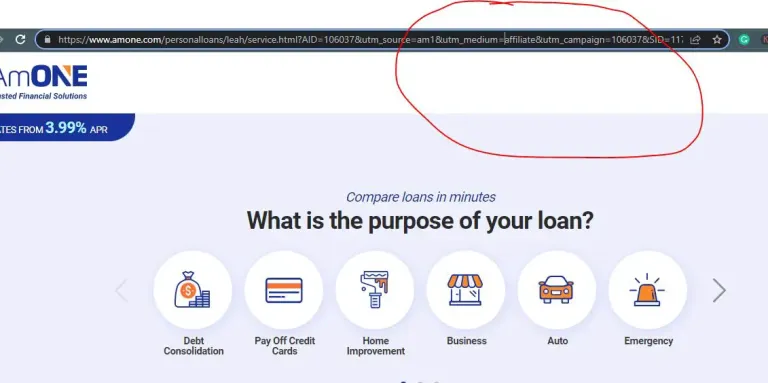

The application link is an affiliate link (as seen above) that will lead you to a website called, Am one, which is part of a loan program that is a legitimate option for many users in the U.S. The AmOne company operates as a loan marketplace, matching borrowers with partner lenders based on their borrowing requirements.

However, if you have no idea about affiliate marketing, It involves referring a product or service by sharing it on a blog, social media platform, podcast, or website. The affiliate earns a commission each time someone makes a purchase through the unique affiliate link associated with their recommendation.

The end result is usually a sale. However, some affiliate marketing programs can pay you for leads, free trial users, website clicks, or app downloads.

First, Cup Loan offers loans with terms of up to five years, which can be used for a variety of purposes including working capital, equipment purchases, and land purchases. Second, the interest rates compared to traditional loans on the Cup Loan Program application are usually lower than those offered by commercial lenders, making it an attractive option for borrowers.

Third, the USDA provides personal advice and technical assistance to program participants at no cost. Finally, the program requires no collateral for loans of up to $50,000, making it a financing option available to many farmers and ranchers.

Whether you are considering applying for a Cup Loan or are already involved in the program, we want to hear from you. We invite you to share your story with us so that we can continue to improve the program and better serve our customers.

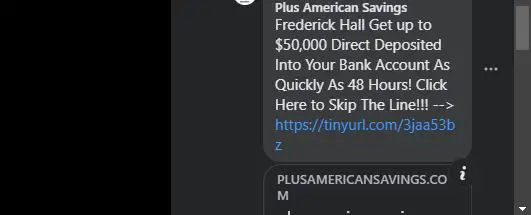

How the Cup Loan Program scam works

The people behind the page trick users into believing they can get up to $50,000 direct deposit into their bank account as quickly as 48 hours, which is a clear red flag.

The page then directs users to a website (plusamericansavings.com) where they must select an option, as shown in the image below. If you select “Good,” you will be taken to the AmOne website; if you select “Bad,” you will be taken to the 5kfunds website.

The people behind the page earn a commission each time someone interacts with the link when trying to apply for a loan.

Note: When clicking links, be cautious. The consequences of clicking on a malicious link can be severe, including data theft, account compromise, and financial loss.

Why Cup Loans Worked for Me

For me, the biggest advantage of Cup Loans was the financial stability it provided through the program’s favorable terms. speed. I had an urgent car repair that couldn’t wait, and the loan came through just in time. The minimal documentation was another plus—no need for endless paperwork, just basic info and a bank statement. It was a relief not having to wait weeks for approval, especially during a time-sensitive situation.

Eligibility: Who Can Apply?

Anyone over 18 with a steady income can typically qualify for a Cup Loan. The requirements are pretty simple:

- Proof of income (recent pay stubs or bank statements)

- Valid ID

- An active bank account

If you meet these criteria, you’re good to go.

My Personal Tip: Pay Attention to the Interest Rates

One thing I noticed is that Cup Loans can come with higher interest rates, especially if your credit isn’t great. Be sure to calculate how much you’ll end up paying back in total before signing up. It’s always a good idea to choose a loan that fits your budget so that you don’t end up defaulting.

Benefits I Found with Cup Loans

- Instant Cash: This type of loan provides quick access to funds for urgent needs. The biggest perk for me was getting the money quickly, which saved me from a lot of stress.

- Flexible Repayment: You can often choose how quickly or slowly you repay, depending on your financial situation.

- Build Credit: If you repay on time, it can help improve your credit score.

Understanding Interest Rates and Loan Terms in 2025

In 2025, the financial landscape for loans has become more dynamic and borrower-friendly than ever. Understanding interest rates and loan terms is crucial for making informed financial decisions. Interest rates are influenced by factors like economic policies, credit scores, and loan types.

Fixed rates provide stability, while variable rates offer flexibility but may fluctuate based on market conditions. Loan terms—the duration over which a loan must be repaid—range from short-term options of 1-5 years to long-term commitments of 15-30 years. An informed borrower always considers the total cost of borrowing, factoring in both the interest rate and loan term to avoid hidden costs and surprises.

2025 Cup Loan Interest Rates Unveiled: The United States Department of Agriculture has released information on the 2025 Cup Loan interest rates.

The 2025 Cup Loan program has unveiled competitive interest rates tailored to diverse borrower needs. With rates as low as 3.5% for qualified applicants, the Cup Loan Program offers affordability and accessibility. Whether you’re planning a home renovation, starting a small business, or revitalizing a rural community, the Cup Loan program’s interest rates stand out as one of the most borrower-friendly in the market.

Applicants with excellent credit scores and stable incomes can access the lowest rates, while flexible options are available for those building credit. Staying updated with current rate trends can help borrowers lock in the best deals, especially when considering low-interest options.

2025 Cup Loan Program: Your Easy Application Guide

Applying for a 2025 Cup Loan is a straightforward process designed with user convenience in mind, ensuring that the program offers low-interest rates. Here’s how you can get started:

- Check Eligibility: Make sure to check eligibility for the facilities loan program to ensure you qualify for the entire loan amount. Ensure you meet the basic requirements, such as minimum income levels and credit score thresholds.

- Gather Documents: Prepare essential documents like ID proof, income statements, and credit reports to review your application effectively.

- Online Application: Fill out the user-friendly application form on the official Cup Loan portal.

- Verification: Submit your documents for verification, which typically takes a few days.

- Approval and Disbursement: Once approved, funds are disbursed quickly, often within a week, allowing borrowers to pay back the loan promptly.

This seamless process ensures borrowers can focus on their goals without unnecessary delays or complications.

Seizing Opportunities with the 2025 Cup Loan

The 2025 opens doors to numerous opportunities for individuals and businesses. Whether it’s funding a startup, upgrading agricultural equipment, or making energy-efficient home improvements, this program caters to varied needs. The low interest rates and flexible repayment options empower borrowers to achieve their dreams without financial strain. For rural entrepreneurs, this loan is a game-changer, providing the capital needed to bring innovative ideas to life. By leveraging the benefits of this program, borrowers can turn aspirations into tangible results.

Revamping Rural Spaces: Cup Loans for 2025

The 2025 Cup Loan program plays a pivotal role in revitalizing rural communities. From improving infrastructure to fostering local businesses, these loans are designed to drive growth in underserved areas. Eligible projects include building community centers, upgrading utilities, and supporting sustainable agriculture. With accessible terms and collaborative efforts, rural residents can transform their spaces into thriving hubs of activity and innovation. By addressing specific local needs, Cup Loans contribute significantly to rural development and economic progress.

Cup Loan Partnering with USDA Rural Development Agency

In 2025, the Cup Loan program’s partnership with the USDA Rural Development Agency has taken financial assistance to the next level, focusing on public facilities. This collaboration focuses on empowering rural communities by offering specialized loans for infrastructure development, housing, and small businesses, as the Cup Loan Program aims to support these initiatives.

Borrowers benefit from the combined expertise and resources of both organizations, ensuring smoother application processes and better financial guidance. Together, they are making significant strides in reducing rural poverty and fostering sustainable growth.

Alternatives to Consider

If Cup Loans don’t seem like the best fit, consider alternatives like:

- Credit cards with 0% APR introductory offers.

- Personal loans can often be obtained through an easy application process, making them accessible to many individuals. from a bank, which might have lower interest rates.

- Borrowing from friends or family, if possible, to ensure a smoother repayment period.

How investigate whether the Cup Loan Program is legitimate or not

| Main Points | Details |

|---|---|

| Research the Lender | Look for online reviews, ratings, and customer feedback on the lender providing the Cup Loan. |

| Check Licensing & Registration | Verify if the lender is licensed to operate in your state or country. Use official regulatory websites. |

| Visit Official Website | Examine the lender’s official website for professionalism, clear terms, and transparent information. |

| Look for Contact Information | Ensure the lender provides a legitimate physical address, phone number, and email. |

| Review Loan Terms & Fees | Ensure the terms are clear, with no hidden fees or excessively high interest rates. |

| Read Customer Testimonials | Be cautious of overly positive or fake-looking reviews. Look for detailed, authentic feedback. |

| Search for Red Flags | Beware of unsolicited offers, upfront payments, or pressure to decide quickly. |

| Check BBB (Better Business Bureau) | Check the lender’s rating with the BBB to see if there are complaints or fraud alerts. |

| Verify with Financial Authorities | Cross-check with government or local financial authorities if there are any known scams associated. |

| Trust Your Instincts | If something feels off, consider exploring other reputable lending options. |

This approach helps ensure a thorough investigation of whether a Cup Loan Program is legitimate or a potential scam.

User Experiences: Real-Life Stories from Borrowers

Borrowers across the country have shared inspiring stories of how the 2025 Cup Loan program has positively impacted their lives. From Jane, a farmer in Nebraska who upgraded her irrigation system, to Mark, a small business owner in Texas who expanded his operations, the benefits are tangible.

These testimonials highlight the program’s accessibility, affordability, and transformative potential, particularly in rural areas, as the USDA Rural Development Office supports such initiatives focused on community use of public facilities. Borrowers frequently praise the simple application process and the support they received throughout their loan journey. These real-life stories underscore the program’s commitment to making a meaningful difference.

My Final Thoughts

If you’re in a tight spot and need money fast, a Cup Loan could be a lifesaver. Just make sure to shop around, read the terms carefully, and choose an option that fits your financial situation. For me, it worked out perfectly, but always assess whether it’s the right choice for your needs.

Users Related FAQ’s

1. What is a Cup Loan Program?

A Cup Loan Program is a type of short-term loan that allows individuals to quickly access funds, typically within a day or two. These loans are designed for people who need immediate cash and usually have fewer requirements compared to traditional loans.

2. How does a Cup Loan work?

You apply for the loan online or in-person by providing basic personal and financial information. Once approved, the funds are deposited into your bank account. You then repay the loan over a set period, usually within a few weeks to months, depending on the lender.

3. What can I use a Cup Loan for?

Cup Loans can be used for various purposes, including emergencies, education, business needs, home improvements, or any personal expenses.

4. How long does it take to get approved for a Cup Loan?

The approval process is typically fast. Most borrowers receive a decision within one or two days, depending on the lender.

5. Do I need a good credit score to apply for a Cup Loan?

No, Cup Loans are often available to individuals with varying credit histories. Even if you have a less-than-perfect credit score, you can still qualify for a loan.

6. What documents are required for a Cup Loan?

Most lenders require basic documents such as proof of identity, proof of income (pay stubs or bank statements), and an active bank account.

7. Are there any hidden fees with Cup Loans?

Reputable lenders will disclose all fees upfront. Always make sure to read the terms and conditions carefully to avoid unexpected fees, such as origination or late payment fees.

8. Can I repay a Cup Loan early?

Yes, most lenders allow early repayment without penalties. It’s a good idea to check the loan terms beforehand to confirm if there are any prepayment fees.

9. What is the maximum amount I can borrow with a Cup Loan?

The maximum borrowing limit varies depending on the lender and your financial profile. Make sure to verify the loan amount during the application process.

10. What are the risks associated with Cup Loans?

While Cup Loans provide quick access to cash, they often come with higher interest rates than traditional loans. Missing payments can also lead to additional fees and impact your credit score.

11. Can I use a Cup Loan to consolidate debt?

Yes, Cup Loans can be used for debt consolidation, but it’s essential to compare the interest rates and repayment terms to ensure it’s a suitable option for your financial situation.

12. How do I apply for a Cup Loan?

To apply for a Cup Loan, you need to research lenders, gather necessary documents, fill out an online or in-person application, and wait for approval. Once approved, the funds are typically deposited directly into your bank account.

Is the Cup Loan program real?

The Loan is a conceptual example designed for illustrative purposes and does not exist as an actual loan program.

Do you have to pay a Cup Loan back, or can it be considered a public facility project?

If a program like the Cup Loan existed, repayment would be necessary as with any loan. Loan agreements typically include specific terms for repayment over a set period.

How much would a $5,000 loan cost per month?

The monthly cost of a $5,000 loan depends on the interest rate and loan term. For example, with a 5% interest rate over 24 months, depending on the loan, you would pay approximately $219 per month. Always use a loan calculator or consult your lender for exact figures.

What happens if you don’t pay your Lending Club loan?

If you don’t pay a Lending Club loan, it can negatively impact your credit score, lead to collection efforts, and possibly result in legal action. It’s important to communicate with the lender if you’re facing difficulties.

Is there such a thing as a Cup Loan program?

No, this loan is a fictional example used for educational purposes, but it could be beneficial for community development projects like fire stations. It’s not an actual loan program.

Are coffee bank loans real?

While “coffee bank loans” is not a recognized financial term, some organizations or cooperatives may offer loans for coffee farmers or businesses within the coffee industry.

Are there any fees associated with the Cup Loan program?

If a program like the Cup Loan existed, it might include fees such as application fees, origination fees, or late payment penalties, which could affect the overall repayment period. Always review loan terms carefully to understand associated costs and how they impact loan recipients.

These FAQs provide clear and straightforward information to help potential borrowers understand the Cup Loan Program and make informed decisions.

Conclusion

The Cup Loan Program is an excellent opportunity for small businesses to access financing when traditional options are not available. However, the Cup Loan Program application is a scam that should be avoided.

share

0 Comments on “CUP Loan program Everything You Need to Know in 2025”